Most people are afraid to buy stocks breaking out to an all-time high (ATH) but still say they want to jump on a rocket stock heading towards the moon! Go figure. Buying a GLB (green line break-out) can lead to huge gains. I draw a green line on a monthly chart at the ATH bar after it is not surpassed for at least 3 months. The concept is to buy a strong stock that has rested and then breaks out again. Not all GLBs work. I sell immediately if the stock closes back below the green line and buy it back if it retakes it. Here are some examples, all weekly charts. You may have heard of some of these and there are many more…….

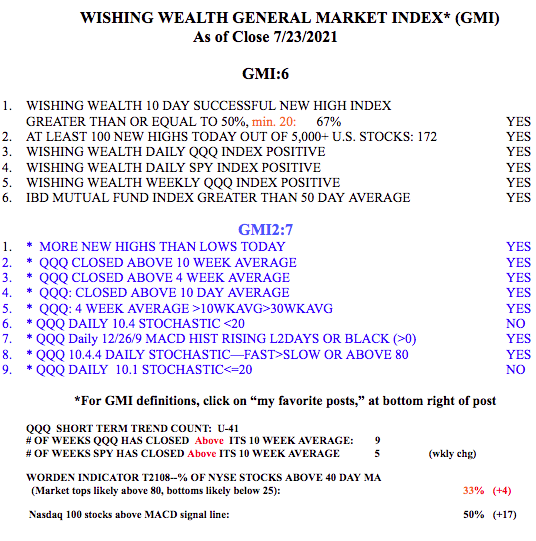

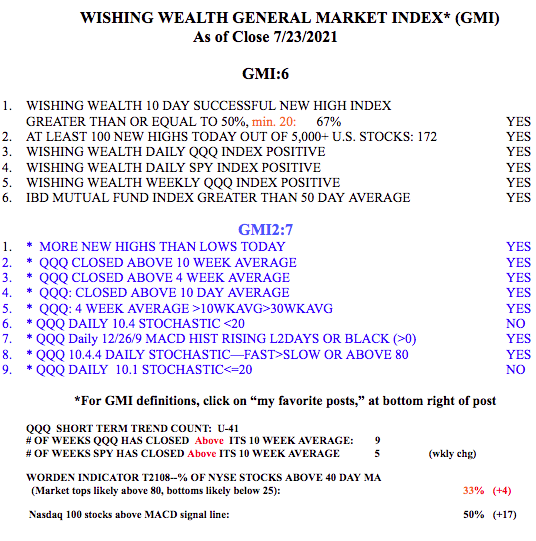

The GMI is at 6 (of 6). All components are positive. Be careful with a Fed meeting this week and the possibility of a delay in raising the U.S. debt limit.