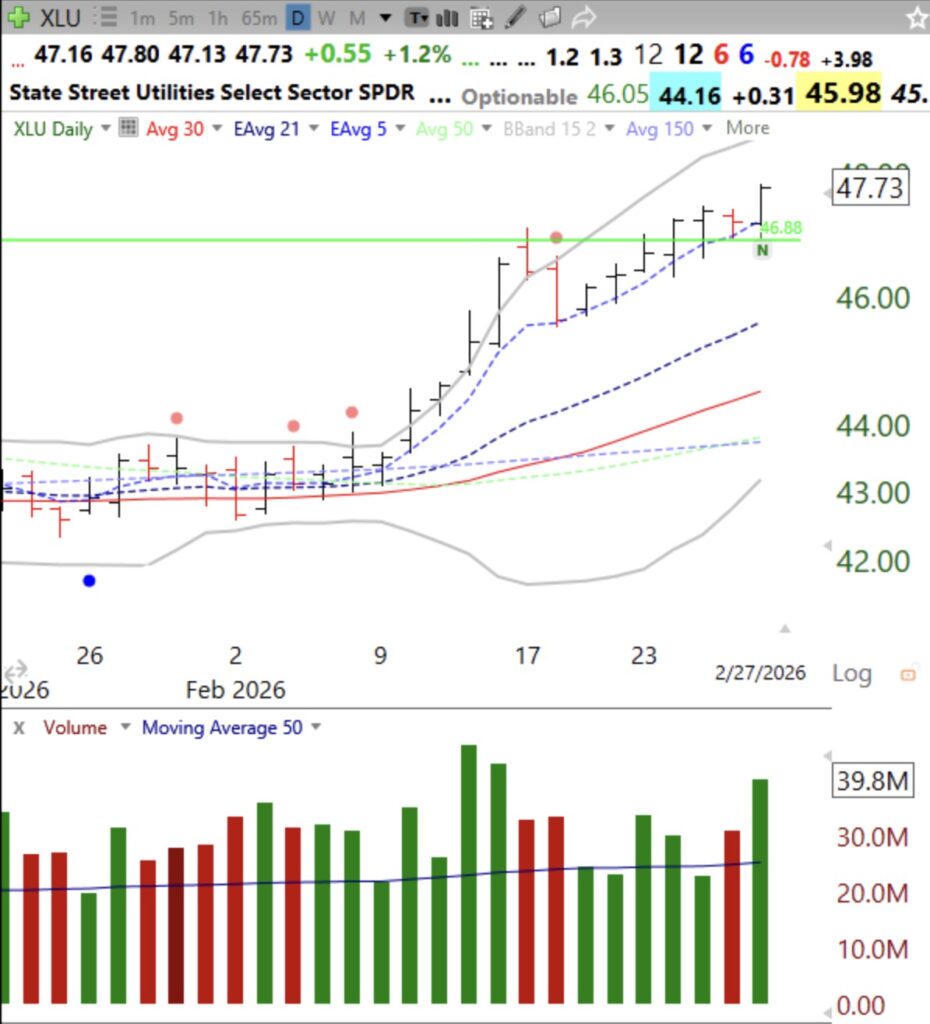

I find it useful to look each day at the industries that had the most stocks reaching an ATH. It shows where money managers are buying. Why are utilities leading? Look at this Utilities Sector ETF that reached an ATH on Friday. It had a recent GLB on above average volume. Note how it is climbing the 5 day EMA. Will the Iran war benefit utilities?

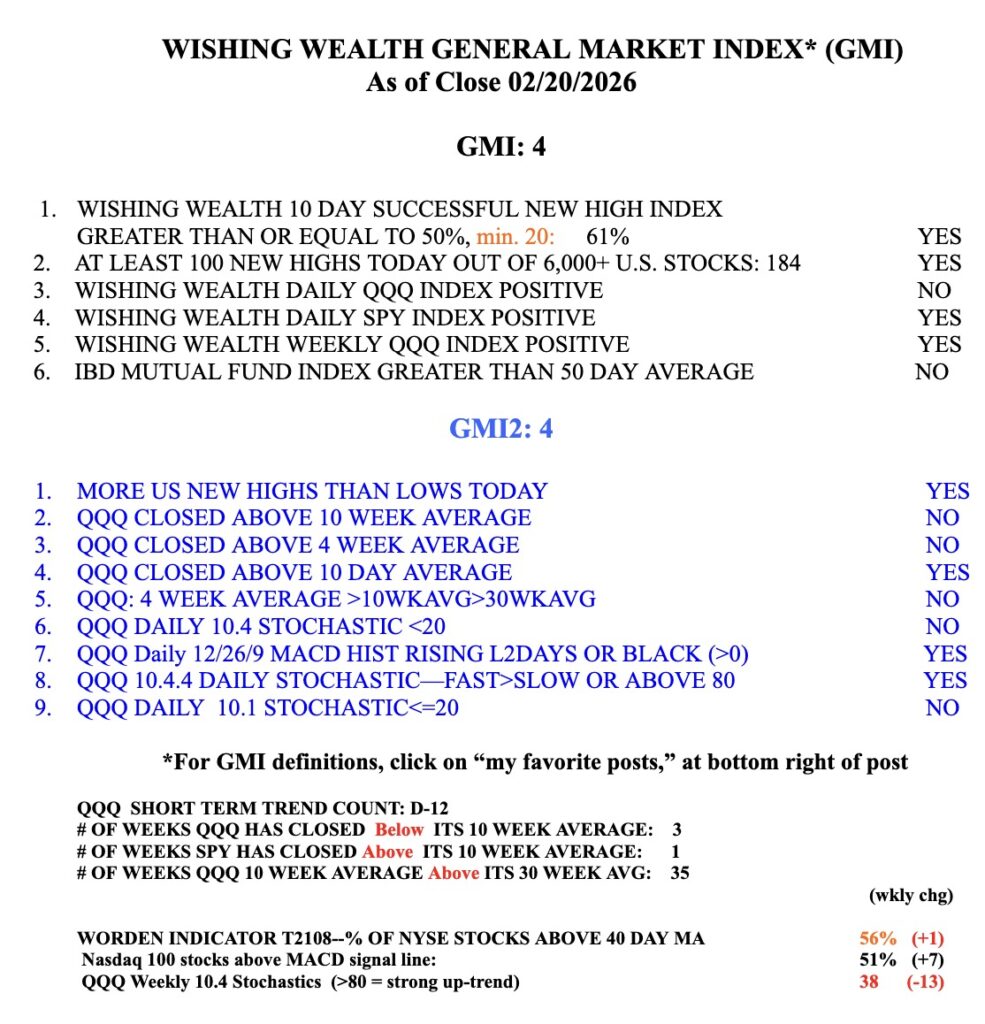

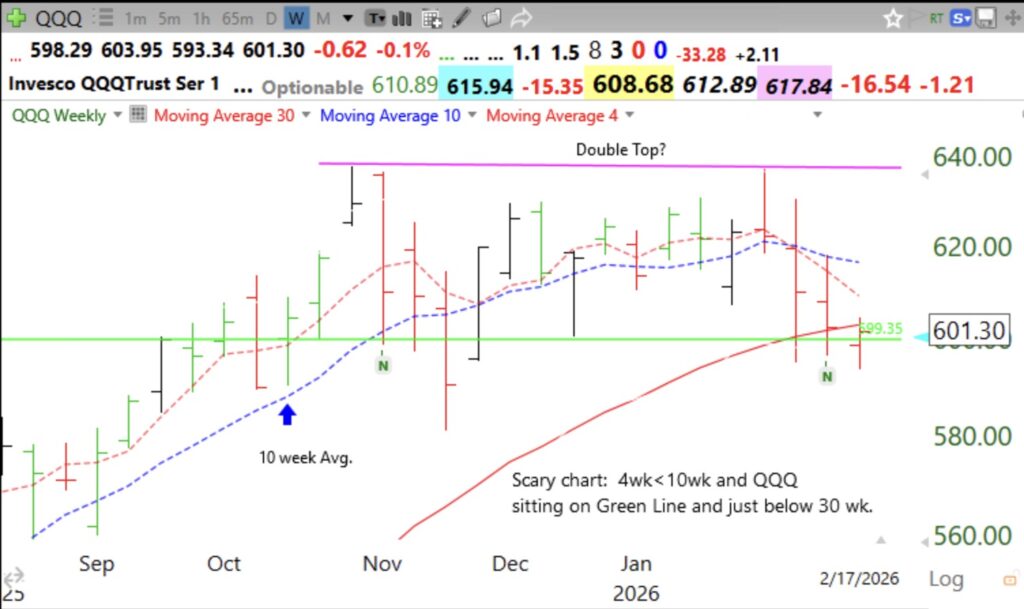

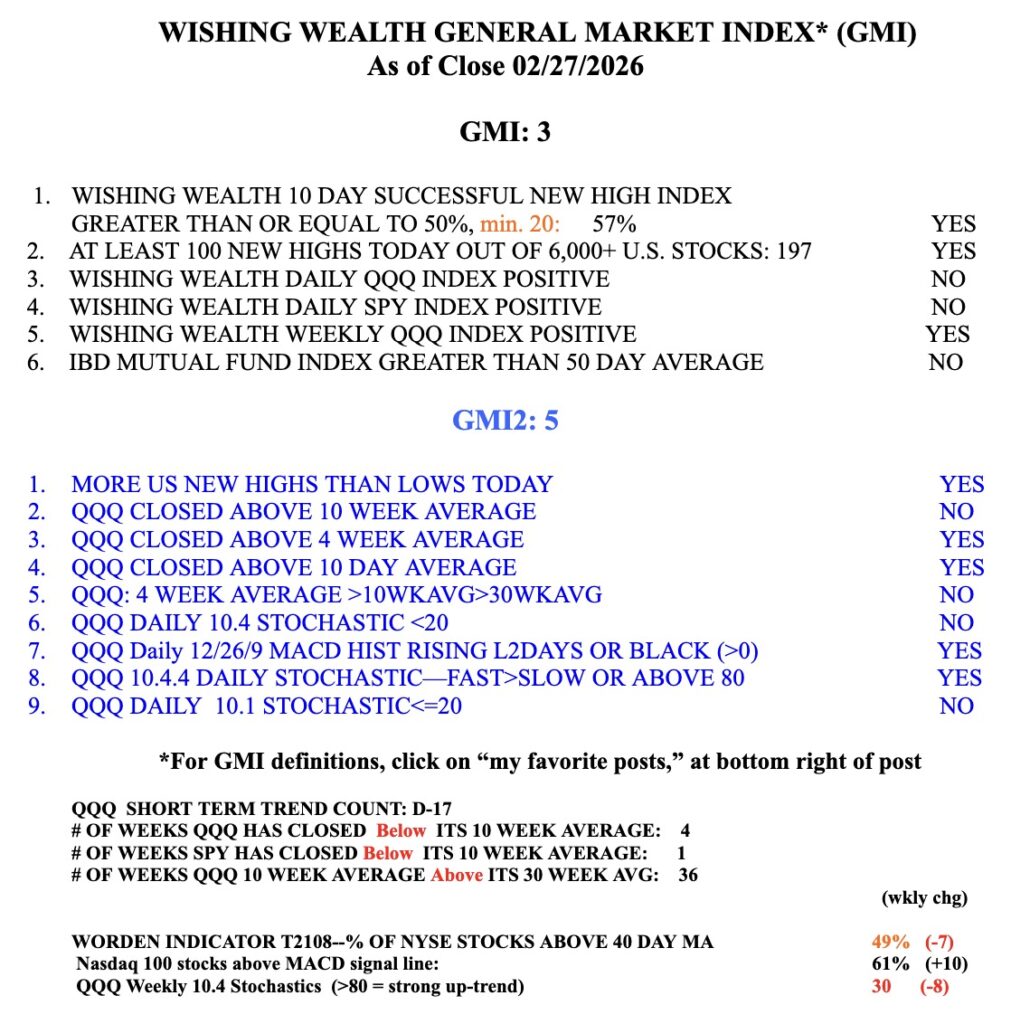

The GMI remains Green but I am mainly in cash in my trading accounts. This market looks weak to me. Note the 10.4 weekly stochastic=30. In a strong up-trend this indicator is >80 for weeks. Don’t fight this market. Trading growth stocks profitably is much more likely when the GMI= 6. The last time the GMI=6 was December 5!

Screenshot