Dr. Wish

Dr. Wish

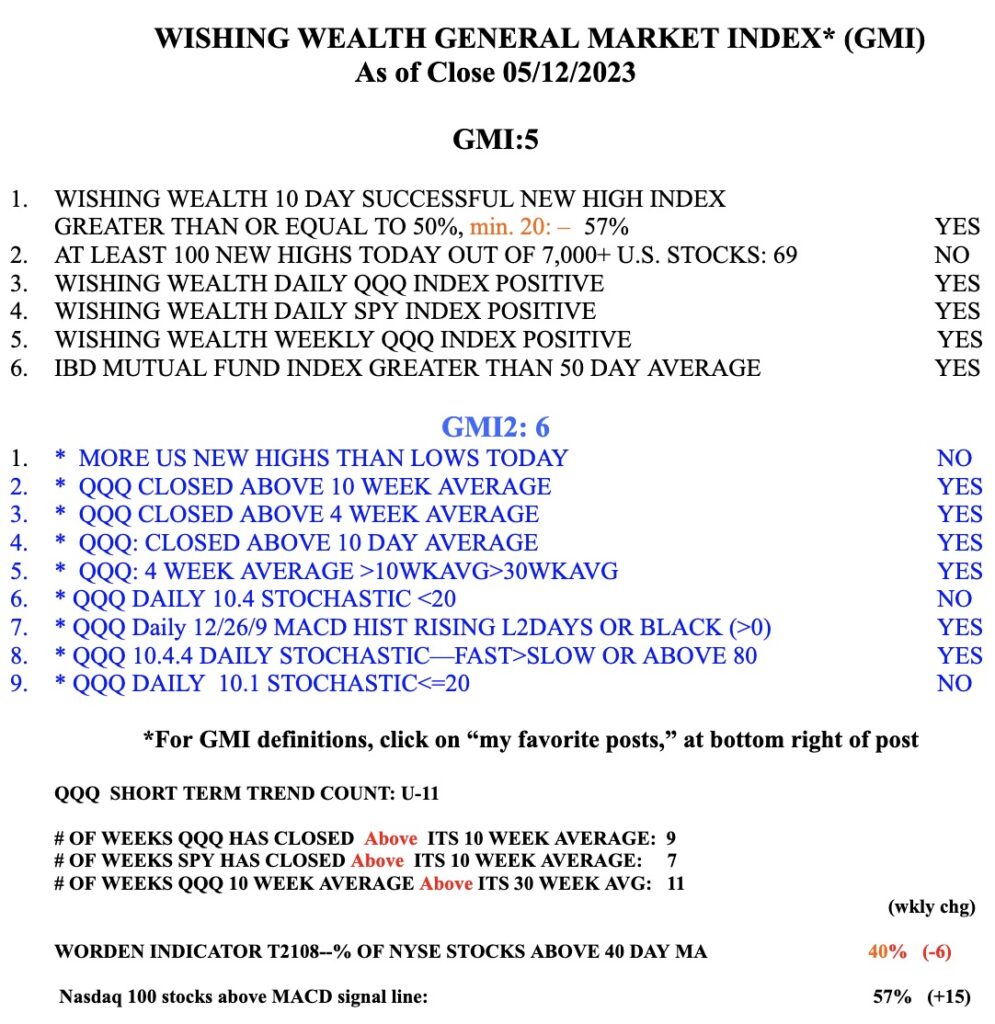

Blog Post: Day 11 of $QQQ short term up-trend; On Friday, 69 new US highs and 131 lows; the GMI remains Green but I am on defense until the debt stalemate is settled

While my indicators suggest that the bottom is in for QQQ, I remain mainly in GLD until the US gets through the debt limit battle. The market fell deeply during the debt battle in 2011 but gold held up until the limit was raised. But there are few new highs each day and more yearly lows than highs. Until the current debt limit issue is resolved, I remain very defensive, but will jump back in on the long side once an agreement is reached. The market indexes have held up under the assumption that all will end well. But the road could still turn very rocky quickly until the resolution. So I wait mainly on the sidelines. The GMI remains strong for now, at 5, of 6.