The QQQQ up-trend continues, completing its 10th day on Thursday. The GMI and GMI-R are at their maximum values. The Worden T2108 Indicator is at 81%, in overbought territory, where it can remain for months. The up-trend that ended on May 4th lasted for 52 days, so the current one cold have a long way to go. Then, again, it could end at any time. Right now, I have some long positions as I wait for a sign that we are entering a Stage 2 up-trend. I must remain vigilant and ready to exit if this young up-trend suddenly ends. I sold out my UNG position with a loss on Thursday.

Dr. Wish

Dr. Wish

Going long—FFIV and other Darvas Scan stocks

Now that the GMI is 6 and many stocks are hitting new 52 week highs again, I am looking for strong stocks to buy. As you know, I prefer to buy stocks that have already doubled in the past year and that are trading at or near their all-time highs. I also want the stock to have appeared on the IBD New America or IBD100 list. FFIV meets all of these criteria. It is also a concept stock selection of my talented stock buddy, Judy. The weekly chart has the technical characteristics I look for, although the stock is extended on a daily basis. Finally, the stock appeared on my Darvas Scan that identifies stocks that have many of the attributes he liked. Below is the monthly chart of FFIV showing that the stock has recently burst through its all-time high reached in late 1999. (Click on chart to enlarge.) I purchased a little of FFIV and will add to it if it keeps rising. Other stocks that appeared on Wednesday night’s Darvas scan include: OPEN, APKT, VIT, BIDU, NTAP, ARMH, HWK, GSIT and IDSA. I own some of these. Please do not ask me to post my Darvas Scan. In the future I will post promising stocks that come up in my scans.

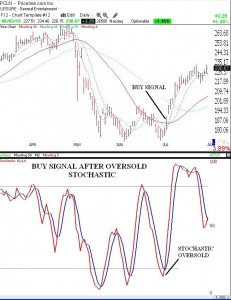

How my “oversold stochastic followed by a buy signal” scan found PCLN

I have been talking about the scan that I use to detect stocks with an oversold stochastic that then go on to produce a buy signal. While I did not buy PCLN when I saw this signal because of the low GMI reading, I did notice PCLN when my scan detected it weeks ago. This is of some note, because PCLN exploded after hours on Tuesday when it released its blow-out earnings. The chart below shows why my scan detected PCLN (click on chart to enlarge). Within a few days after its stochastic declined to oversold levels, below 20, PCLN closed above its 30 day average, indicating a buy signal for me. You can see for yourself what happened next. This scan does not typically work so well in a down market, but I have found that in an up-trending market it can work quite well. In the coming days I will list some stocks that are picked up by my scan. Just remember, no technique is perfect and one must always use stops to minimize losses.