The market rally continues, with many stocks breaking out. There were 229 new 52 week highs in my universe of 4,000 stocks on Monday. The following stocks at new highs were near multi-year highs and had triple digit earnings increases in their most recent quarter: SAN, CTXS, PPO, CMI, OPEN, HWK, BIDU, ALK. I own some of these. The new high list is a great place to look for promising growth stocks. Check out this monthly chart of BIDU, (click on chart to enlarge), a true rocket stock.

Dr. Wish

Dr. Wish

The stochastic of the Worden T2108 suggests rally to continue? 4 stocks with high relative strength

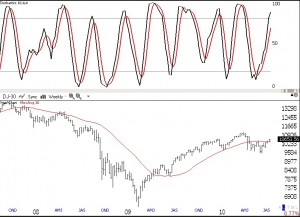

I know many people doubt the ability of this rally to continue. But the QQQQ short term up-trend is only 11 days old! I decided to apply the stochastics indicator to the Worden T2108 Indicator. The T2108 acts as a pendulum of the market, going from overbought to oversold, as does the stochastic. The weekly chart below (click on to enlarge) shows the stochastic of the T2108 compared with the performance of the Dow 30. What is clear to me is that the stochastic, while high, is still climbing and shows no sign of an impending decline. So this rally may have a ways to go.

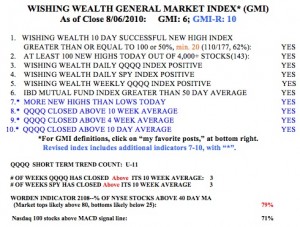

The GMI is 6 (of 6) and the more sensitive GMI-R is 10 (of 10).  The SPY and QQQQ have closed above their critical 10 week averages for three straight weeks. The T2108 is at 79%, which is in overbought territory, but it can stay there for weeks. I ran a new scan that finds stocks with a relative strength rank of 95 or higher for three time periods. Among these stocks were 4 that are also on my IBD100 or New America watch lists: IDSA, CRUS, APKT, NFLX. I own one of these. I think it is worth researching these stocks for possible buy points.

The SPY and QQQQ have closed above their critical 10 week averages for three straight weeks. The T2108 is at 79%, which is in overbought territory, but it can stay there for weeks. I ran a new scan that finds stocks with a relative strength rank of 95 or higher for three time periods. Among these stocks were 4 that are also on my IBD100 or New America watch lists: IDSA, CRUS, APKT, NFLX. I own one of these. I think it is worth researching these stocks for possible buy points.

10th day of QQQQ short term up-trend

The QQQQ up-trend continues, completing its 10th day on Thursday. The GMI and GMI-R are at their maximum values. The Worden T2108 Indicator is at 81%, in overbought territory, where it can remain for months. The up-trend that ended on May 4th lasted for 52 days, so the current one cold have a long way to go. Then, again, it could end at any time. Right now, I have some long positions as I wait for a sign that we are entering a Stage 2 up-trend. I must remain vigilant and ready to exit if this young up-trend suddenly ends. I sold out my UNG position with a loss on Thursday.