I am on vacation this week and cannot do all of my customary analysis. Markets still look like they could bounce this week, but they remain in a down-trend. One of Judy’s picks hit a new high on Monday, DXCM. Be careful.

Dr. Wish

Dr. Wish

Raising cash; some submarine stocks; Indexes’ daily stochastics oversold

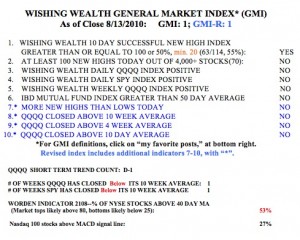

With the GMI and GMI-R now at one, the technical signs are just too weak to own stocks. The QQQQ has just started a new short term down-trend (D-1) by my criteria. The 30 week average of the QQQQ is flat, which leads to many whipsaws of the indexes above and below the shorter term moving averages.  For example, the last short term down-trend lasted just 4 days, then we had a brief 15 day up-trend, which just ended. The SPY and QQQQ are now below their 10 week averages. My long trades are most likely to be profitable when these indexes remain above their 10 week averages. Only 27% of the Nasdaq 100 stocks now have their MACD above its signal line, a sign of short term weakness. Finally, the Worden T2108 indicator is at 53%, in neutral territory. So, we are in a declining market, but not yet in an oversold state. Most market declines end with the T2108 below 20%. And soon we enter the typically weakest month of the year for the market–September.

For example, the last short term down-trend lasted just 4 days, then we had a brief 15 day up-trend, which just ended. The SPY and QQQQ are now below their 10 week averages. My long trades are most likely to be profitable when these indexes remain above their 10 week averages. Only 27% of the Nasdaq 100 stocks now have their MACD above its signal line, a sign of short term weakness. Finally, the Worden T2108 indicator is at 53%, in neutral territory. So, we are in a declining market, but not yet in an oversold state. Most market declines end with the T2108 below 20%. And soon we enter the typically weakest month of the year for the market–September.

In a market like this there are many submarines–stock in likely longer term down-trends. Some of them picked up by my submarine scan are: BBBB, SNX, RTN, WDC, JCG, MR, VPRT, MD, TEVA, ASIS, LIFE, MHS, SLAB, ATHR. During market down-trends, I sometimes buy deep in the money puts on submarine stocks in my IRA. There is one caveat keeping me from entering new short positions right now. The daily stochastics for the DIA, SPY and QQQQ are in oversold territory–we may get a bounce during the coming week of options expiration.

GMI falls to 2; extreme caution needed; protecting capital

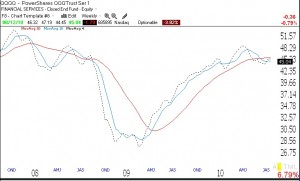

The GMI and GMI-R are each registering 2. Don Worden wrote Thursday night about a possible head and shoulders top, as I did 2 days ago. I am not yet ready to call a top. It will take a few more declines to convince me. But with a GMI of 2, it is prudent to be defensive and to raise stops and cash. With two of the bull market leaders, NFLX and PCLN, hitting new all-highs on Thursday, it is hard to say that the bull is dead. We could just as easily be setting up a head and shoulder’s top as a bottom! The market has bounced around in a range for quite a while. The chart below (click on to enlarge) shows the weekly plot of the QQQQ and its 4,10 and 30 week averages. If we look at the prior recent tops, one can see that the 4 week average typically falls below the 10 and the 30 week averages and leads the decline. At the present time, the 4 week average (black dotted line) is above the 10 week average (blue) and below the 30 week average (red). As long as the 4 week average remains above the 10, I am not ready to call it a major down-trend. Still, there is no reason to be brave when the market averages look like this. Better to conserve my capital until things look better.