After the huge run-up last week, unless the up-trend is broken, I am holding my positions at least through end of the quarter window dressing during the last week of September. The market leaders appear to be holding up well.

Dr. Wish

Dr. Wish

Rallly gains momentum; AAPL breaks out; FFIV– another rocket and IBD New America stock

What a day Monday was–the best for my accounts in years. AAPL broke out and most of my stocks climbed. There were 392 new 52 week highs in my universe of 4,000 stocks, the most since last April. But last April marked the end of a major 13 month rise off of the 2009 bottom. We are just breaking out now, however, so we may have a long up-trend in front of us. With all of the negative sentiment around us and the apparent reluctance of people to embrace this rally, I think this up-trend has legs. AS a tend follower, I jump on this trend and ride it until after it ends.

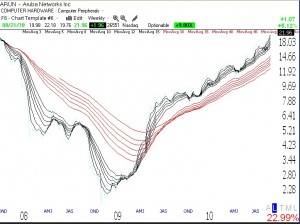

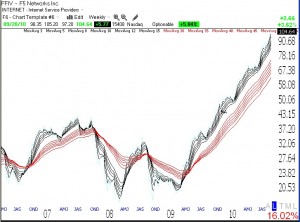

The GMI remains at 6 (of 6) and the GMI-R at 10 (of 10). The only indicator that I track that is a little troubling is the T2108, now at 82%, and close to overbought levels. But the T2108 can stay above 80 for a while. Below is the weekly GMMA pattern of another rocket stock, FFIV. Unfortunately, I did not hold it long enough. Note the “NA” on the chart (click on to enlarge) shows when IBD wrote about FFIV last December in their daily New America column about a promising company. The stock has doubled since then. The time to buy a stock is when it rockets to a new all-time high like FFIV did last November, around $47. The stock closed Monday at $104.64. I keep a watch list of New America companies. People who refuse to buy stocks at new highs miss out on the rocket stocks. Jesse Livermore used to say that stocks are never too high to buy (or never too low to sell short). He was the consummate trend follower.