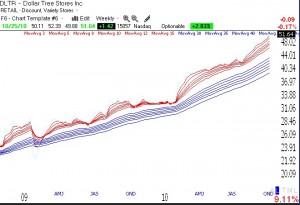

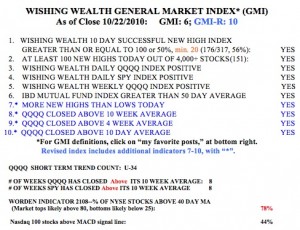

There were 447 new 52 week highs in my universe of 4,000 stocks on Monday. For now, GLD has bounced off of support. Another RWB rocket stock: DLTR.

Dr. Wish

Dr. Wish

Beware of Gold, looking at DZZ

For the first time since last July/August, the gold chart looks ominous (see daily chart of GLD below). The 4 day average (red dotted line) has now crossed below the 10 day moving average (blue dotted line). GLD gapped down on huge volume 3 days ago and it has had 3 big volume down days (red spikes) since then. My perspicacious stock buddy, Judy, exited GLD (the gold ETF) 2 weeks ago after buying in around $70 in 2008. GLD has also now closed below its 4 week average, after having traded above this average since last summer. The long term support for GLD has been at its 30 week average since early 2009 and it is far above that now. If I were to bet on a short term down-trend in GLD, I would buy the double short ETN, DZZ. I would wait for a close of GLD below its 30 day average (solid red line), currently at $128.50. However, as long as GLD remains above its 30 week average, it remains in a Stage 2 long term up-trend.