While the short and long term up-trends are intact, the leaders look very tired. Six of the nine leaders I follow declined on Tuesday, as did 64% of the Nasdaq 100 stocks. CMG and BIDU look very weak. NFLX has bounced up off of support and it will be important to see if it can hold. AAPL has been slowly inching up, but GOOG has been weak…..

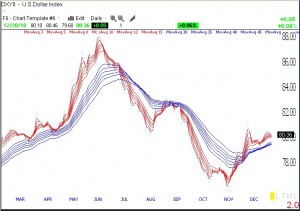

MCP, a hot rare ore play, had a high volume reversal on Tuesday and GLD seems to have resumed its up-trend. However, the dollar is now headed up, as shown by this daily GMMA chart, where all short term averages (red) are now above the longer term averages (blue). Click on chart to enlarge.