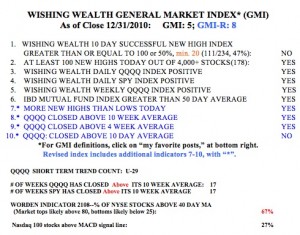

There was weakness in the leaders on Friday with all nine stocks declining, and five of them have closed below their 30 day averages. Only 28 of the Nasdaq 100 stocks rose.  Furthermore, only 27 of the Nasdaq 100 stocks closed with their MACD above its signal line, reflecting short term weakness. Nevertheless, the short and long term trends of the major indexes (SPY, DIA, QQQQ) remain up. I am invested 100% in mutual funds in my university pension, but in my IRA trading account I am holding long positions that are largely protected by put options. As I explained in a post in 2009, buying puts for insurance is an effective strategy for controlling risk, especially for large long positions. I am uncomfortable when market leaders like NFLX, CMG and BIDU weaken.

Furthermore, only 27 of the Nasdaq 100 stocks closed with their MACD above its signal line, reflecting short term weakness. Nevertheless, the short and long term trends of the major indexes (SPY, DIA, QQQQ) remain up. I am invested 100% in mutual funds in my university pension, but in my IRA trading account I am holding long positions that are largely protected by put options. As I explained in a post in 2009, buying puts for insurance is an effective strategy for controlling risk, especially for large long positions. I am uncomfortable when market leaders like NFLX, CMG and BIDU weaken.

Dr. Wish

Dr. Wish

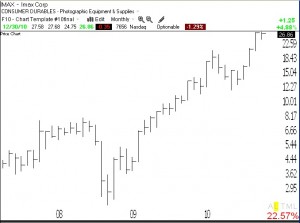

Judy picks another possible buy-out winner: IMAX

Yesterday, I bought some call options (actually a bull vertical spread) on IMAX because it bounced from support. I have been following IMAX for years because my stock buddy, Judy, had alerted me to it, in April 2008! Judy liked the 3D theater concept. Check out my first post on IMAX. Judy tells me she first bought IMAX at about$1.25 per share. It is trading premarket today at $30 based on buy out rumors. Over the years a lot of Judy’s “concept” stocks have been bought out by other companies. From time-to-time I post Judy’s picks. Here is a monthly chart of IMAX. (She obviously bought IMAX cheaper before 2008.)

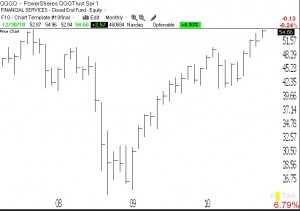

Closing out a great year for the QQQQ, near its 2007 peak; Happy New Year!

Do not look for predictions of the market over the next year. No one knows what the market will do. All we can do is discern the current trend and ride it until it ends. We end the year in the middle of a QQQQ short term up-trend, which reached day 28 on Thursday. The prior short term up-trend lasted 51 straight days and was followed by a 2 days short term down-trend. With the exception of this brief down-trend, the market has been rising for 79 days! It doesn’t get much better than this. The monthly chart of the QQQQ (Nasdaq 100 index ETF) shows the large rise in tech stocks since the early 2009 bottom, followed by a few months of consolidation in 2010 and the continuation of the up-trend for the past 4 months. The QQQQ has risen +18.4% since December 30, 2009. At Thursday’s close of 54.66, the QQQQ is slightly below the 2007 pre-decline top of 55.07. Will it hit resistance here? The Worden T2108 indicator is only at 65%, in neutral territory. So, I will remain fully invested in mutual funds in my university pension, and holding stocks and options in my trading accounts. Next year will undoubtedly bring some down-trends, and I will reduce or eliminate my long positions when they become evident. Until now, let’s all enjoy this incredibly strong market up-trend. Happy New Year to all of my valued readers. I hope you have benefited from my posts. Let me know.