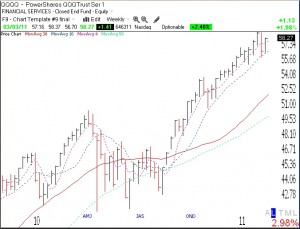

The GMI and GMI-R are both indicating a general market up-trend. The Worden T2108 is back to 74%, still in neutral territory. Meanwhile this weekly chart of the Nasdaq 100 index shows it to be in a firm up-trend since September. The key bullish pattern of 4wk>10wk>30 wk average is evident and the index has continually found support at its 10 week average (blue dotted line). I have to relearn the lesson over and over again, to focus on weekly trends, so as not to be shaken out of the market by daily fluctuations. Note also the Stage 2 up-trend, with the index well above the rising 30 week average (red line). A key sell signal for me will be a close below the 10 week average, currently at 56.83. For those of you new to charting and technical analysis, you can use the free chart program at freestockcharts.com. Just add the moving averages, 4,10,30 as indicators and select the week as your time period on the chart. (Click on chart to enlarge.)

Last December, I wrote about a Judy’s pick, TDSC, at around $31. Yesterday TDSC rose 10% to $53.29, an all-time high. My stock-buddy, Judy, researches “concept” stocks, and finds more future winners than any other person I have ever met.