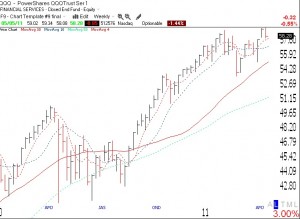

My indicators are holding up, in spite of the recent declines in many key stocks. The QQQ was very extended and is just coming down to the major trend lines. I still remain mostly on the sidelines until leading stocks start to rise again. I own a little QID and a little AAPL. If one falls the other should rise.

Note how this weekly chart shows the QQQ returning towards the 4 wk average (red dotted line) and/or 10 week average (blue dotted line). As long as the QQQ remains above its 10 week average, I am confident of the up-trend. Click on chart to enlarge.