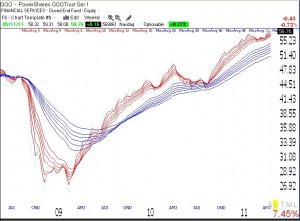

Thank you for your patience and many nice inquiries. I have been maintaining my indicators while the site was down, but do not have them with me. The GMI = 2 and the QQQ began a short term down-trend on Tuesday, May 17. I am completely hedged or in cash in my trading accounts. This has been the most tricky market in months. The longer term trends remain up so I remain invested in mutual funds in my university pension. If the short term down-trend in QQQ continues I will nibble at QID. Option expiration is this weekend.

Given the harsh treatment of momentum stocks the past few weeks, I am not willing to place large bets now. I have been worried for weeks that AAPL could not go on to new highs.

By the way, Judy has been talking to me about MAKO for quite a while. She loves the concept.