My AAPL positions gained nicely. I wrote on July 11 that I was buying AAPL. I increased my position in QLD on Tuesday and transferred my university funds from money market funds to growth funds again. I am starting to buy individual stocks too. I have been learning to use the Worden TC2000 Platinum version which enables real time scanning and quotes. For the first time I can create a watchlist that shows which of my weekly, daily and hourly indicators are positive–all in real time as they change. I will be sharing some exciting new strategies soon.

Dr. Wish

Dr. Wish

QQQ passes 12th day of short term up-trend; buying again

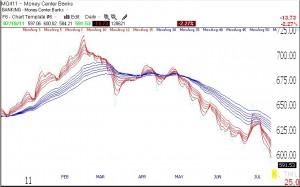

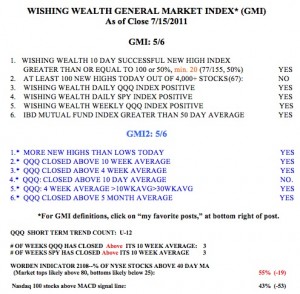

In spite of all of the bad news about raising the debt ceiling, the up-trend continues. With the GMI and GMI2 each registering 5 (of 6), I must respect this up-trend.  I do not think we would be seeing such buying in GOOG or AAPL if this market were going to enter a prolonged down phase. I began worrying about the tech stocks when AAPL could not go to a new all-time high. But it did so on Friday after consolidating for 20 weeks, and GOOG climbed almost 13% ($68). The bulls are still alive. The Worden T2108 indicator is at 55%, in neutral territory. The QQQ and SPY have spent 3 weeks back above their 10 week averages. And the QQQ now has the strong 4wk>10wk>30wk averages pattern. So, I am slowly wading back into this market.

I do not think we would be seeing such buying in GOOG or AAPL if this market were going to enter a prolonged down phase. I began worrying about the tech stocks when AAPL could not go to a new all-time high. But it did so on Friday after consolidating for 20 weeks, and GOOG climbed almost 13% ($68). The bulls are still alive. The Worden T2108 indicator is at 55%, in neutral territory. The QQQ and SPY have spent 3 weeks back above their 10 week averages. And the QQQ now has the strong 4wk>10wk>30wk averages pattern. So, I am slowly wading back into this market.