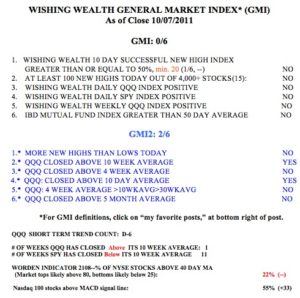

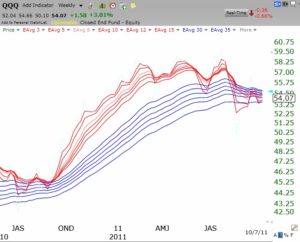

According to IBD, the market is still in a correction. Monday’s gains came on lower volume than on Friday. The QQQ short term trend will turn up on Tuesday if the QQQ stays level or positive today. The GMI-2, which is more sentivie to short term trends, is 3, of 6. In fact, the GMI could turn to 4 with an up day on Tuesday. The T2108 indicator, at 42%, is well into neutral territory. I am content to wait for the GMI to rise to 4 before I tiptoe back into the market on the long side. In the meantime I will scan the new 52 week high list for potential leaders to put on a watch list. Among Tuesday’s winners are: SXL,CELG,QCOR,DLTR,CEPH,ROST,LO. All of these have recent quarterly EPS increases of 19% or more and ROE of at least 17%.

Dr. Wish

Dr. Wish

5th day of QQQ short term down-trend

We are still waiting to see if this rebound has legs. Longer term trends remain down.