T2108 doe not go much higher. While the long and shorter term trends remain up, I am looking for a post earnings release lull.

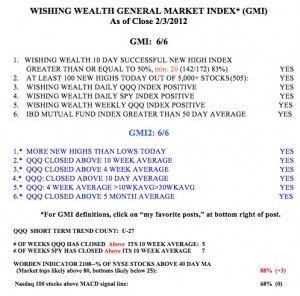

The GMI flashed a buy signal on December 23rd, which is still in place. Since December 23rd, the QQQ has advanced +10.7%, the QLD +22.2% and the TQQQ +34.7%. Meanwhile during the same period, only 12% of the Nasdaq 100 stocks and 11% of the S&P500 stocks have advanced 20% or more. The 3X bullish semiconductor ETF, SOXL, rose +52.8% during this period. The 3X leveraged ETF’s outperform almost all stocks and are much easier to select than individual stocks. I learn this lesson during each multi-week up-trend. Why try to identify the rare stocks that will outperform a 3X ETF?! Just pyramid up on the ETF.

I have many positions where I sold cash secured put options that should expire worthless in two weeks. I will then look to open new covered call positions or sell new cash secured puts.