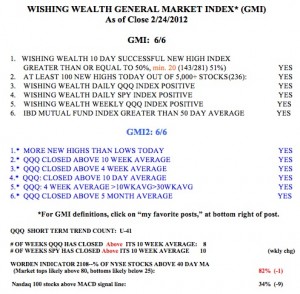

The GMI remains at 6 (of 6). The Worden T2108 Indicator is starting to decline. Only 34% of the Nasdaq 100 stocks closed with their MACD above its signal line. Nevertheless, the long and short term trends remain up, for now.

Dr. Wish

Dr. Wish

39th day of QQQ short term up-trend

GLD and mining stocks continue to climb.