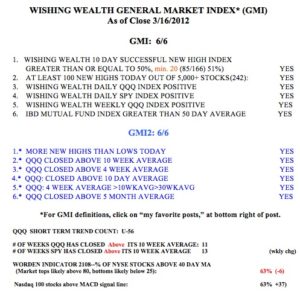

The GMI remains at 6, and the up-trend continues. T2108 is at 63%, in neutral territory. GLD still looks weak, however. Meanwhile, HLF has broken from a base to an all-time high. Check out this nice weekly chart.

T2108 is at 63%, in neutral territory. GLD still looks weak, however. Meanwhile, HLF has broken from a base to an all-time high. Check out this nice weekly chart.

Stock Market Technical Indicators & Analysis

GLD declined on Wednesday. Gold and silver are in down-trends.