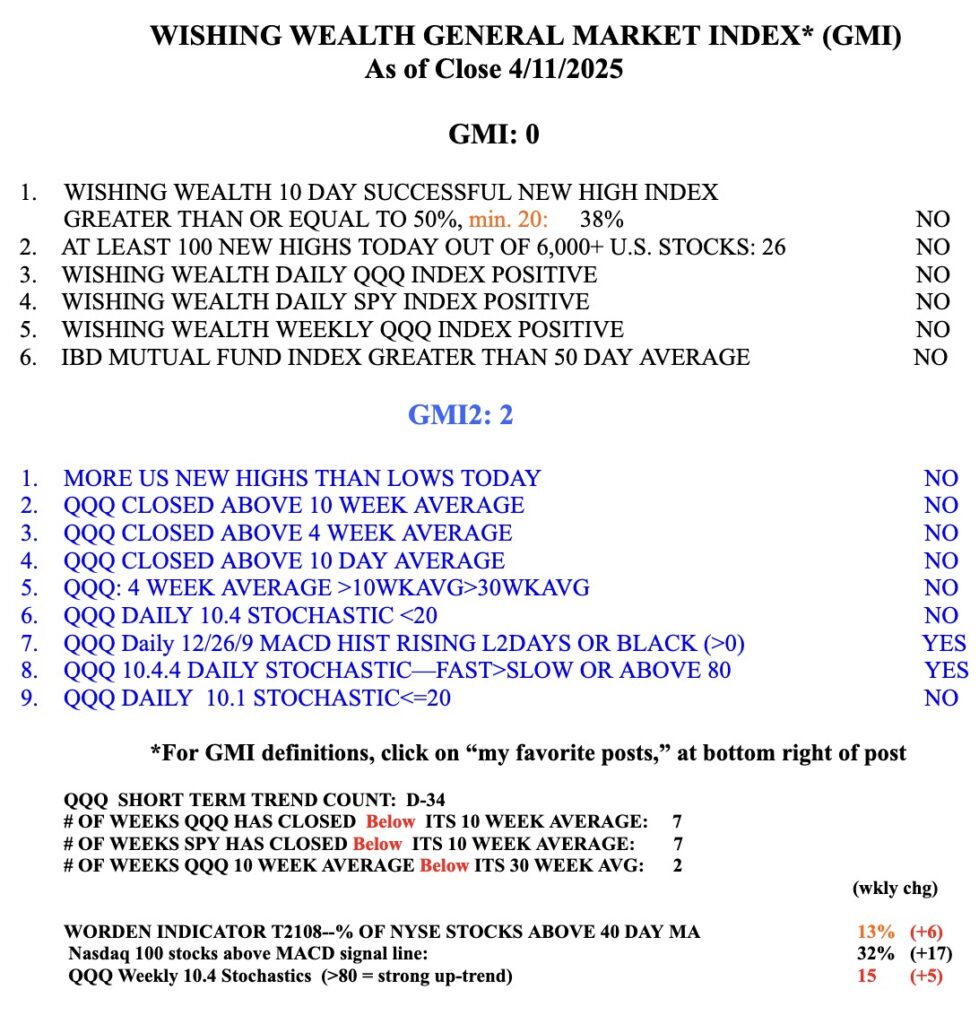

Last week I posted that when a stock in a down-trend has a gap below the declining 4 wk average it often means the stock is extended on the down side and it will often rebound to close the gap. See on this weekly chart where the original gap was and that it has been closed. This pattern happened last week with the SPY, QQQ and DIA. To indicate emerging strength, the index must first close the week above its 4wk average. Then when the 4wk avg rises above the 10 wk avg and then the 10 wk avg rises above the 30 wk average we have a possible up-trend. Right now the 4wk (red dotted) is well below the 10wk (blue dotted) which is declining below the 30 wk (solid red). It takes a lot of discipline to refrain from buying the sudden sharp bounces in declining stocks way below their highs. The most successful traders know how to do this. I prefer to wait to buy the first stocks that come through the market carnage and reach ATHs. Most of these will emerge once the indexes have begun a strong advance. That is also when the GMI , now RED, will flash Green. With the 30wk average curving down, we may be at the beginning of a Weinstein Stage 4 downtrend. See TraderLion’s just released Stage Analysis Model Book. When a Stage 4 down-trend unfolds, the index sometimes rebounds to kiss the 10 week or even the 30 week average. This can be a good time to sell out if one had missed exiting. Plenty of time for me to get back on board once the new up-trend is established. Look at the nice long advance that began in late 2023, that I noted on this chart.