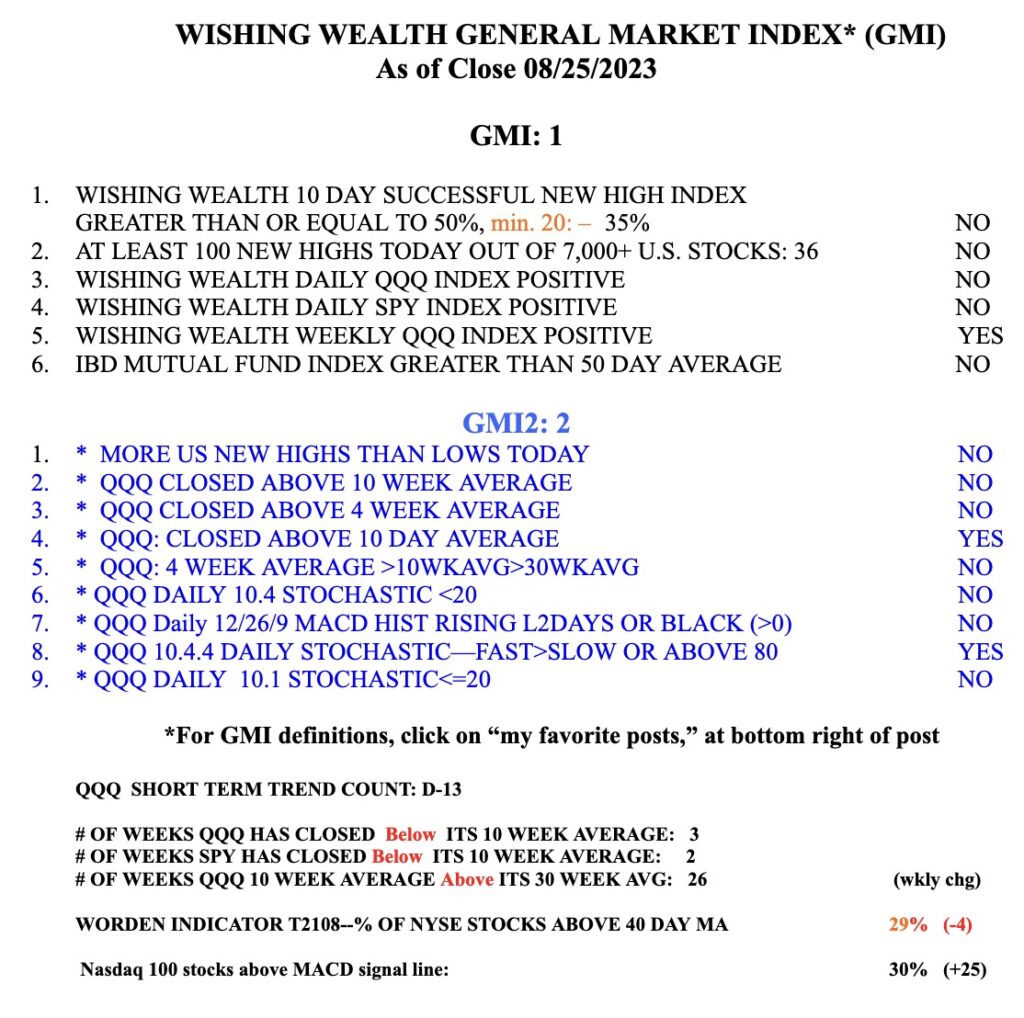

QQQ’s 4wk average is now below its 10 week average, a sign of technical weakness. Failure to retake the 4 wk average (red dotted line) this week would suggest to me at least a decline to the 30 week average (red solid line at $337). The weak month of September is on tap and the GMI=1 and is Red. Time to be in cash, short (in SQQQ) or on the sidelines.

SQQQ is the the triple leveraged inverse of QQQ.

Another way to be short QQQ is to purchase a deep in the money put option on QQQ. If QQQ declines in September to the 30 week average, the put could rise a lot. For example the September, 29 380 QQQ put is trading at about 17.75 x100= $1775. Break even is 380-17.75= 362.25. Every point that QQQ is below 362.25 leads to a gain in the put of $100. If QQQ declines to 337 between now and the end of September, this put would trade at around $43 (380-337), yielding a gain of $25.25 (x 100) on an investment of $17.75 or +142%. The risk, of course, is that QQQ rises a lot and one could lose the entire cost of the put. When you buy an option you cannot lose more than you paid for it, so at least your loss is capped. Study how options work. I like Michael Sincere’s book, “Understanding Options.” I used to assign it to my honors course students.