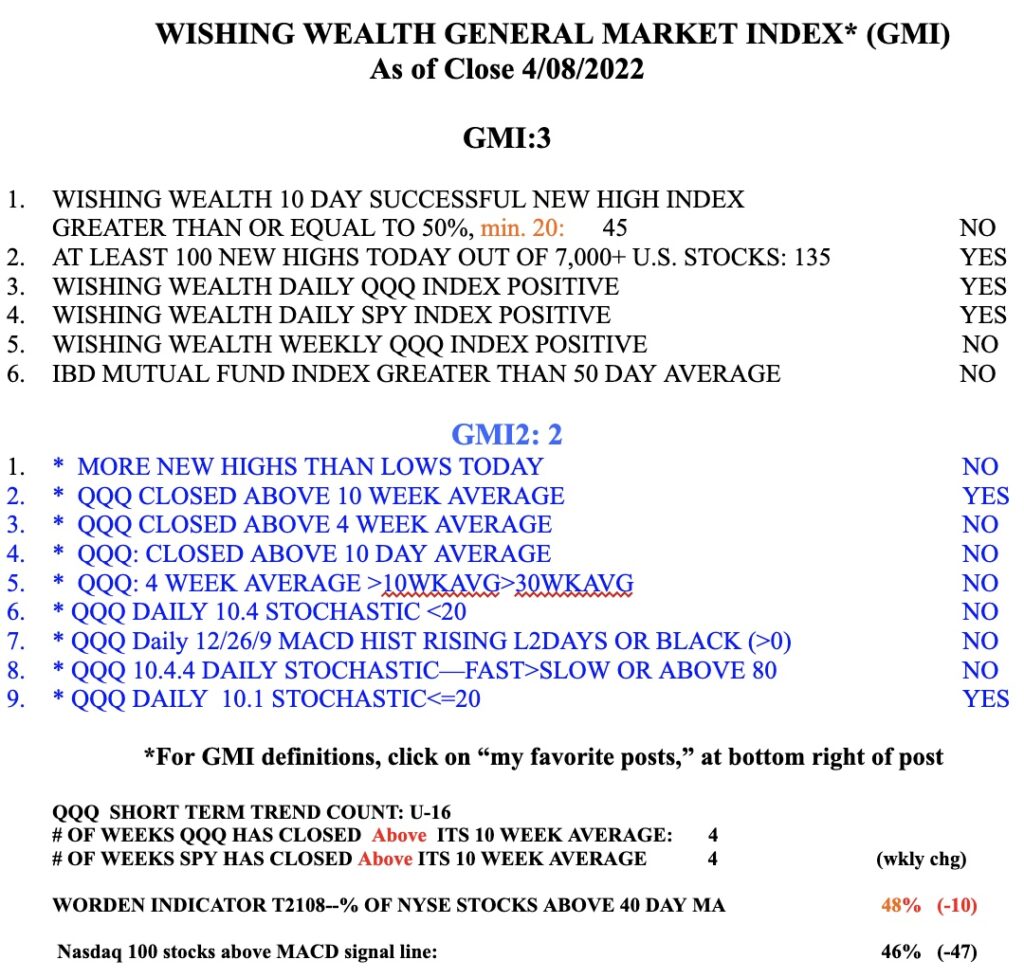

This year has been a miserable time for the major stock indexes and their components. Their weakness, reflected in my GMI table below, obscures the fact that there is still a bull market in nontraditional sectors, especially those related to oil drilling, agriculture, medical distribution and drugs. So although the traditional big caps and tech stocks are weak, there are other places one might look for winners. (But I remain mainly in cash.) NVO, SBOW and BMY had green line break-outs (GLBs) to all-time highs (ATH) last week. A GLB indicates that the stock has reached an ATH, then consolidated for a minimum of 3 months and then broken out to a new ATH. For me, a GLB is the best indicator of a potential market leader. However, not all GLBs are successful. If I buy one, I sell the moment it closes back below the green line. Many times a stock has a GLB and then returns to it. As long as it does not close below the green line I retain it. If a stock closes below the green line and then returns above it I may buy it back.

Here are three GLBs I identified this weekend. All had above average trading volume last week, a good sign. Remember, break-outs are more likely to fail in a declining market. And the GMI is just 3 (of 6). On the other hand, the GMI2 table shows the daily 10.1 stochastics is very oversold (2.8) a level where the market often bounces. ABBV is one recent example of a successful GLB, followed by the three new stocks. Most people do not understand that a break-out to an ATH can be the start of a major advance. Any stock trading at an ATH in this market environment has a lot going for it. If I miss the GLB, I might buy the stock if it later bounces off of a key moving average, like the 4 wk and 10 wk, see chart below for examples where these would have been good entries.

Hi Dr. Wish,

Thank you for sharing your system and thoughts so freely. May I ask on what timeframe you usually play those GLBs? Do you enter right when it trades above the green line and volume (e.g. vol-buzz) confirms the breakout or do you wait for a daily/weekly close above the green line?

Regarding the stop, do you exit once the daily closes below or rather the weekly? Do you also employ a worst case stop-loss regardless of the close below?

Hi Dr. Wish,

How do you handle position sizing? How many positions max?

Tx,

Ernie

I try to set an alert in TC2000 when the stock trades above the green line. I may buy it immediately if the volume buzz is large or wait to see where it is going to close. Stocks often return to their green line and I try to wait for a close below to sell. If it come back above I may repurchase it. Failed GLB can lead to a large decline. It is a good idea to check out a weekly chart before selling as long as it is above the green line.