I regret that I changed the word scared to concerned in yesterday’s post when I characterized my current take on the market. With 438 new lows and 232 new highs registered Monday, I am even more concerned/scared about the market’s near term future. I have been reviewing the perspicacious writings of Marty Zweig and Ned Davis and am struck by their urgent advice not to fight the Federal Reserve’s intentions.

When the Fed moves to raise rates the stock market and even the economy gets a cold or worse. Higher rates suck $$$ out of stocks because people can earn a decent return in interest type instruments rather than from more risky stocks. With inflation zooming, does anyone think rates will not go higher? Now that Powell has learned he will keep his job he can start raising short term rates.

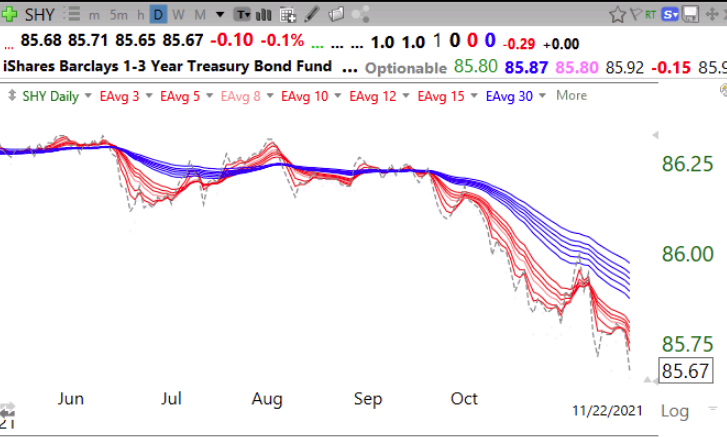

The trend in short term rates can be tracked by the 1-3 year treasury bond ETF, SHY. The chart below shows that SHY is already in a daily BWR (shorter term red averages well below declining longer term blue averages) down-trend. Lower bond prices mean higher interest rates as bond traders sell current bonds that pay minimal interest and pursue newly issued bonds paying higher rates.

You may sign up for this blog by completing the box on this page or follow the titles I post by tweet: @WishingWealth. A possible rise at the end of the 4th quarter mutual fund window dressing period in late December may offer the last chance to exit the market unscathed.

Thanks for this post and the continued blog

As usual, a good posting. Thank you Dr. Wish.

Also, there is some evidence that when rates increase from a “low” rate, the impact on stock prices for a time can be less than expected as some industries like banks and insurance companies can actually benefit. They become more profitable as they quickly charge higher rates to customers but only very slowly and grudging raise returns to investors. The following chart can be interesting to review after pressing the Animate button. Rates vs the performance of the stock market. https://stockcharts.com/freecharts/yieldcurve.php.