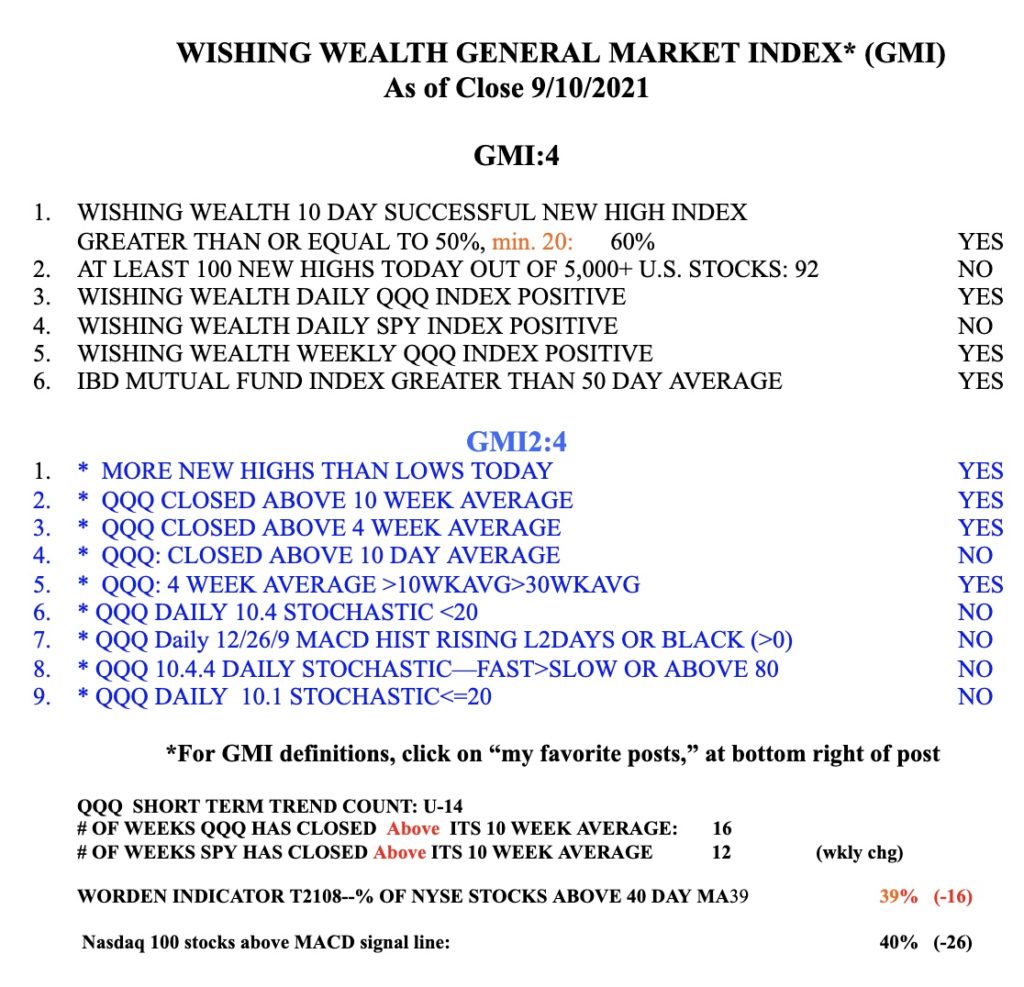

I am very cautious with the GMI falling to 4 (of 6) and with the current huge event risk: September/October seasonal weakness, a likely fight over raising the debt limit and possible Fed tapering. One positive element for me is possible mutual fund window dressing the last week of September (end of 3rd quarter) when strong stocks get bought up by funds trying to spruce up their quarterly reports. We shall see. I think the best position now may be cash. AAPL had a rough day Friday and needs to hold its green line. A failed GLB would be a bad sign for the general market indexes.