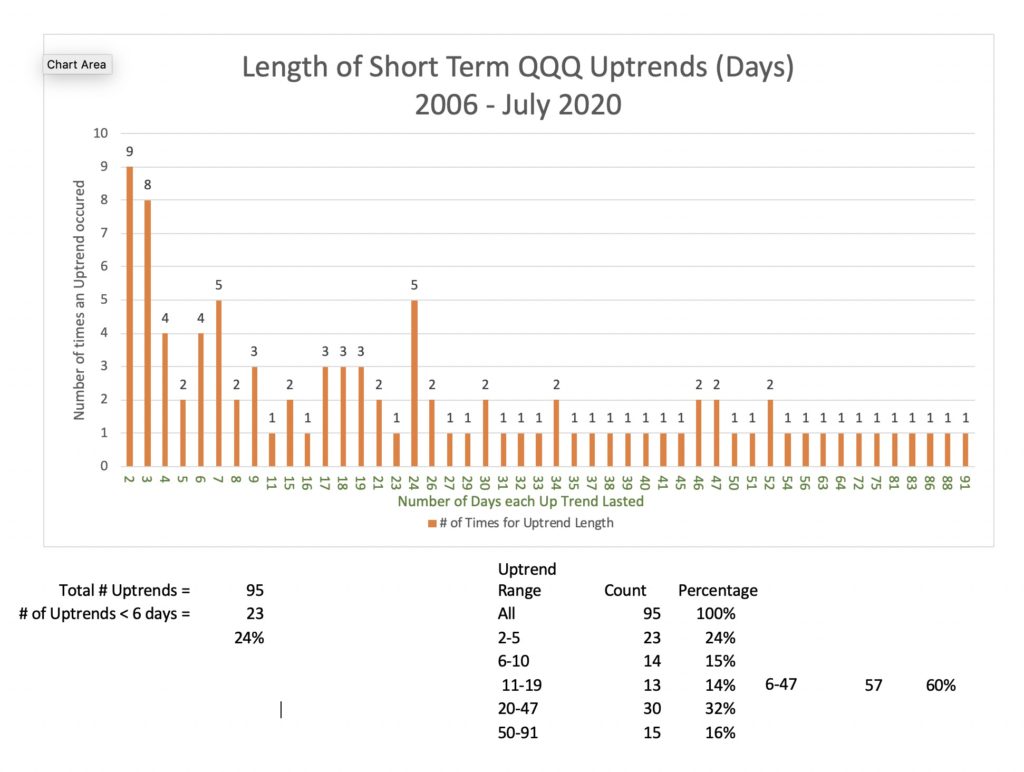

As my readers know, I compute each evening the number of days that the QQQ has been in a short term up-trend or down-trend. (I have a proprietary objective method for designating changes in the short term trend, so don’t ask for it.) Since 2006 there have been 95 short term up-trends. The current up-trend has now reached 67 days. The longest short term up-trend since 2006 lasted 91 days, from October 14, 2019-February 24, 2020. This was followed by a 30 day short term down-trend that included the steep March decline. One of the reasons I became so cautious in February was because the up-trend had gone on for so long. The fact that the current short term up-trend has now reached day 67 leads me to suspect the current up-trend will end soon. The ending of a short term up-trend and the start of a down-trend does not necessarily signify a large market decline. The down-trend could be very short. Nevertheless, I have one foot out the door now. I post the short term trend count, now U-67, in the GMI table each weekend.

very interesting, thanks for sharing! Do you have similar numbers for downtrends?

Do you believe that the last uptrend in 2019 would have continued till now if the pandemic never happened, or would there have been a natural correctional downtrend?

How do you define a short-term uptrend?