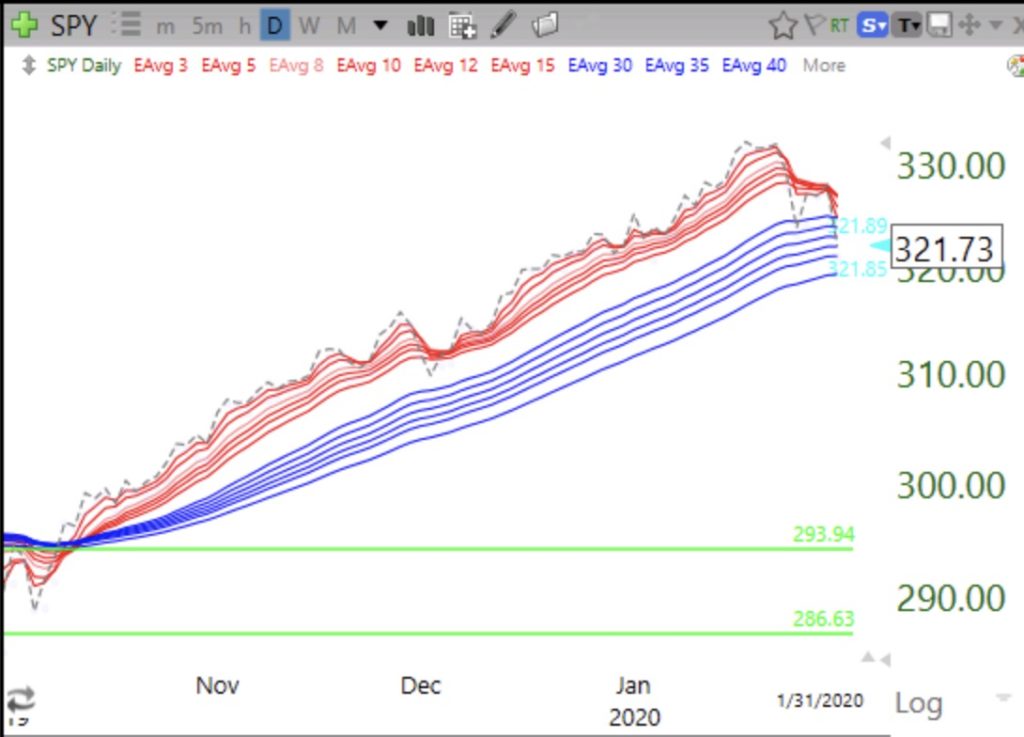

The put/call ratio closed at 1.06 on Friday. It may need to reach 1.15 or above to have a short term bottom. This ratio is a measure of fear among option traders. The more puts traded relative to calls, the more option traders are betting on a decline or protecting their holdings against one. The P/C ratio is a contrary indicator such that extreme levels of fear tend to precede a bounce in the market. Other indicators I monitor are making me cautious. The QQQ has closed below its 4 week average for the first week since early October, a sign the sustained rise is likely over. And the SPY has actually closed below its 10 week average for the first time since last August. The daily RWB pattern for the SPY is also gone. (see chart below.) The white space between the fast and slower averages has disappeared. And the QQQ short term up-trend has completed 76 days. No QQQ short term up-trend since 2006 has gone beyond 88 says and only 4 of 94 up-trends reached 80 days. I therefore suspect we will see more short term weakness leading to the end of the short term up-trend. While the coronavirus is the ostensible reason for the current weakness, the market was due for a decline anyway. After 75 days, everyone was making money and thinking the market only goes up. Remember the two sayings, a bull market makes everyone look like a genius, and you don’t know who is swimming naked until the tide goes out….

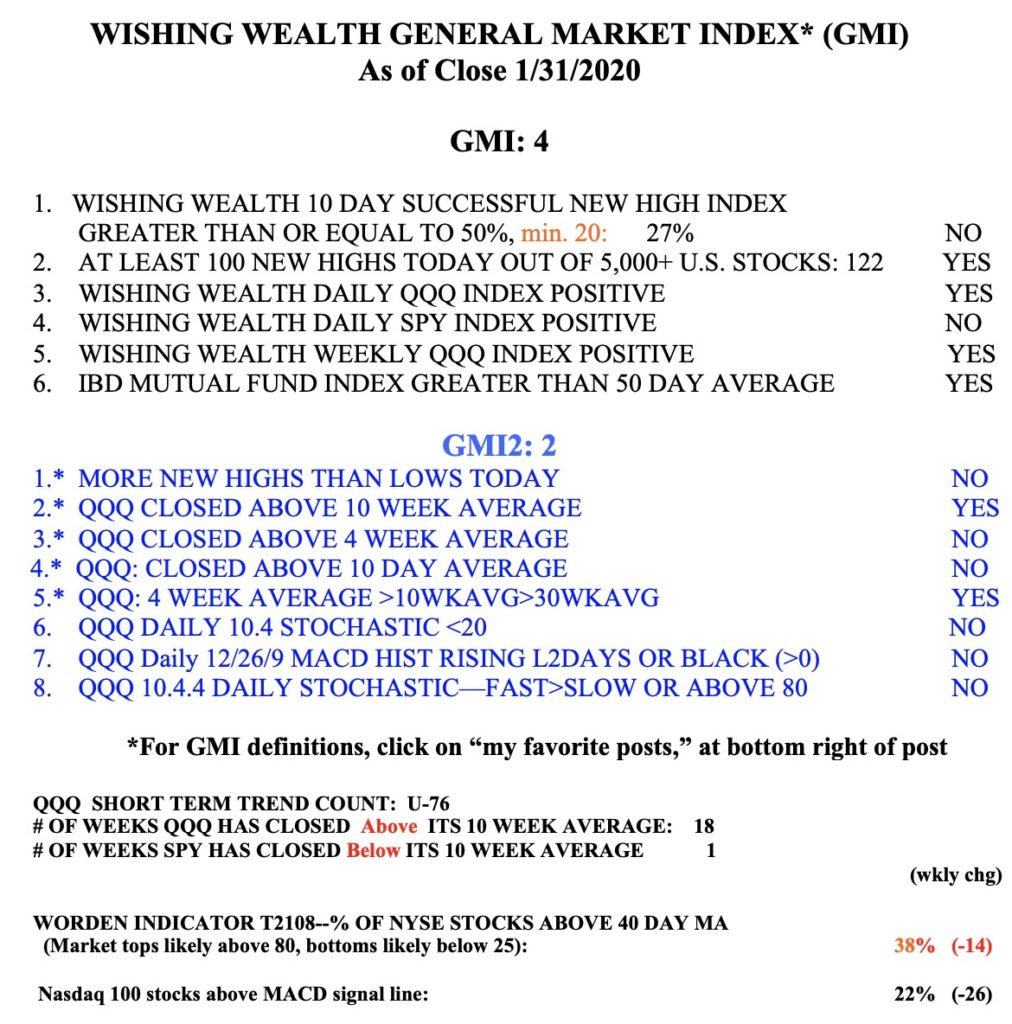

The GMI is at 4 (of 6) and still Green. That means the longer term trend remains up and so while I am in GLD in my trading accounts, I remain invested in index funds in my longer term pension accounts.

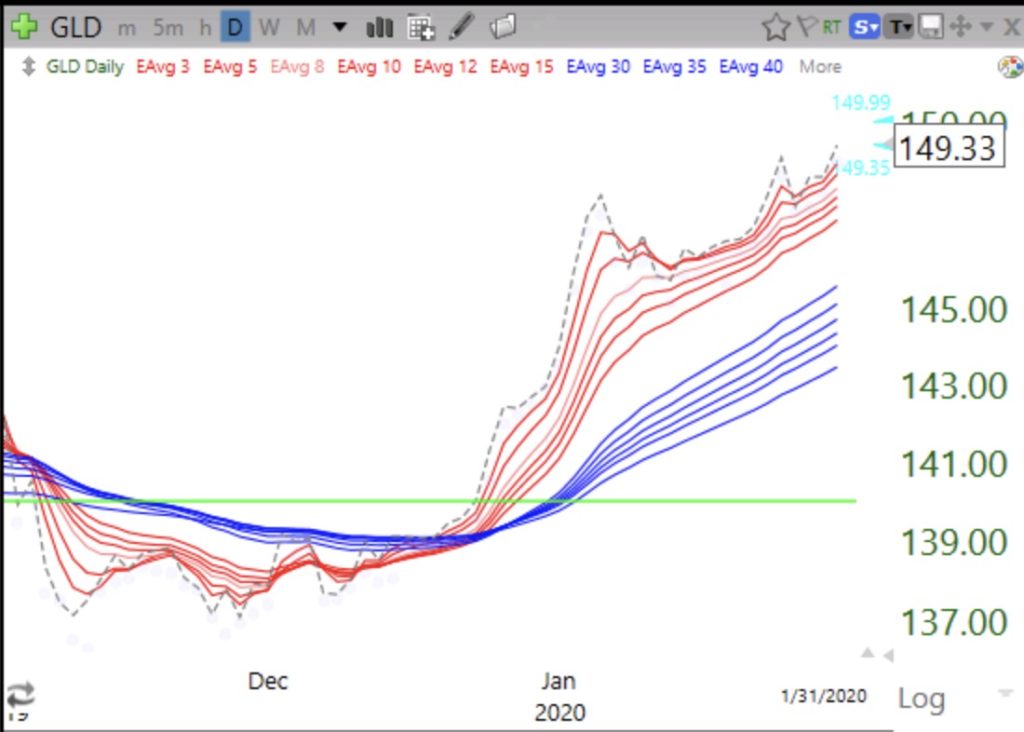

GLD remains in a daily RWB up-trend.