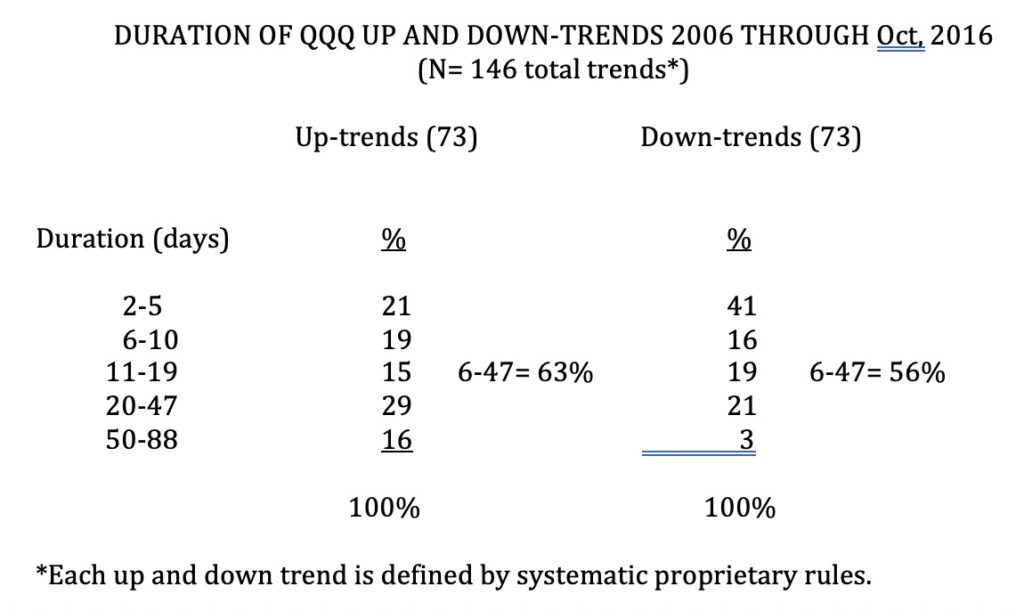

Since January 9, the first day I initiated a QQQ short term up-trend count, the QQQ has advanced +13.6% while its triple leveraged ETF, TQQQ, has advanced +43.1%. Once again, I find that merely buying TQQQ when the QQQ short term trend turns up would have given me major gains and beaten most stocks. By the way, the longest QQQ short term up-trend count I have computed from 2006-2016 lasted 88 days and only 16% lasted 50 days or more.

Do you find it profitable to short QQQ (or buy an inverse fund) during show term downtrends?

Hi Dr. Wishing,

Have you done a comparison of your system to the SectorSurfer system? The website link attached to this message is a 3X leveraged set of Direxion funds. Does your system using TQQQ perform similarly to the SectorSurfer system. I follow both you and SectorSurfer signals.