In 2000 and 2008 I went to cash in all of my accounts and avoided the market carnage. The major signal that I followed was the curving down of the 30 week moving average of the QQQ. This time I have been in cash earlier because I am more conservative as I approach retirement. I know its seems counterintuitive, but the QQQ now appears to be entering a Weinstein Stage IV decline. If this is true, the down-trend is just beginning. The only thing to get me back into this market on the long side would be if the indexes can close back above their 30 week averages and the averages begin to rise. This strategy has worked great for me.

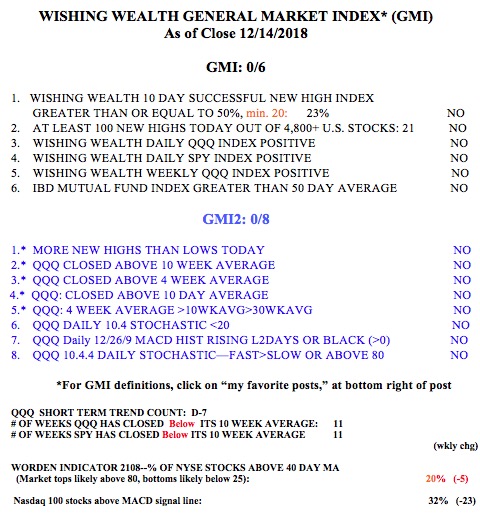

On Friday there were 21 new highs and 763 new lows in my US stock universe of over 4900 stocks. With odds like that, why try to buy stocks at new highs hoping that they continue higher? ? The best tactic of late has been shorting stocks that are trading at new lows.

All 6 of my GMI and 8 of my GMI2 indicators are negative.

I took your class in Spring 2011. The market has doubled since then. Have you doubled your Spring 2011 portfolio since then? If I have a 25 year time horizon (I’m 29 now, retiring at 54 sounds good), why shouldn’t I just dollar cost average into VTSAX instead of constantly staring at charts?