I lost my dear sister who resided in Boston, last week, after a 10 month illness. After a brief rest, I am now ready to get back to my blog and to my audience. Thank you to those who enquired regarding my absence from blogging. Coming face to face with mortality helped me to sharpen my thoughts about the market.

I have two goals. I teach young people who have a lifetime ahead of them how to manage market risk while investing in growth stocks. My undergraduate students have, hopefully, learned some valuable lessons during the current market decline about the value of going to cash (which they cannot do during their virtual 7 week trading exercise), of using stop losses and of remaining invested during declines only in large market index ETFs that will eventually come back with the U.S. economy.

My second goal is to support persons nearer my age, the boomer generation, based on my market experiences over the past 50 years. We boomers must preserve our hard earned capital first and foremost so we can live independently the rest of our lives. I cannot ride a market down and hope that it will come back in time to rescue my financial future. While the market “always comes back” it is noteworthy that the Dow took about 26 years to come back after the infamous 1929-1932 decline. And don’t forget that the Dow’s track record is biased towards the optimistic side because the index managers periodically replace the “dogs” in their indexes with new, stronger companies. Do you really think Apple or Microsoft were in the original Dow industrial index formed in the 1880s? Since GE was dropped from the Dow in June, 2018, none of the Dow’s original 12 component stocks remain in the index. Thus, the performance of the Dow over time is skewed towards profitability by the 52 substitutions that have already been made. The other indexes also follow this practice of replacing underperforming stocks.

I am at a loss when people who have remained invested in a declining market ask me what they should do now. I do not allow myself to be in that situation because I am a chicken and cut back my holdings as soon as my indicators weaken. The GMI, which had been Green for a long time, flashed a Red signal on October 8. I was already in cash in my university pensions but quickly went to cash in my IRA trading account too. Nicolas Darvas (order his invaluable books below) wrote in the 1960’s that when his purchases repeatedly failed, the market was warning him to exit. When that situation occurred to me this fall I cut back. Another stock guru, William O’Neil (WON), also wrote about the importance of the general market’s trend, signified by the “M” in his CAN SLIM approach. I am amazed at how many followers of the WON IBD approach that I read are still trying to go long in a declining market. I suggest that their egos induce them to search for the rare stock that can resist the market’s trend. The great Jesse Livermore, another guru, as well as other successful traders have written that one must resist the temptation to always be in the market. One of the early successful traders, Baron Nathan Rothschild, when asked how he got so rich, is said to have replied, “I never buy at the bottom and I always sell too soon.” Bernard Baruch repeatedly shorted and exited the market near the top in 1929, until he hit the trend.

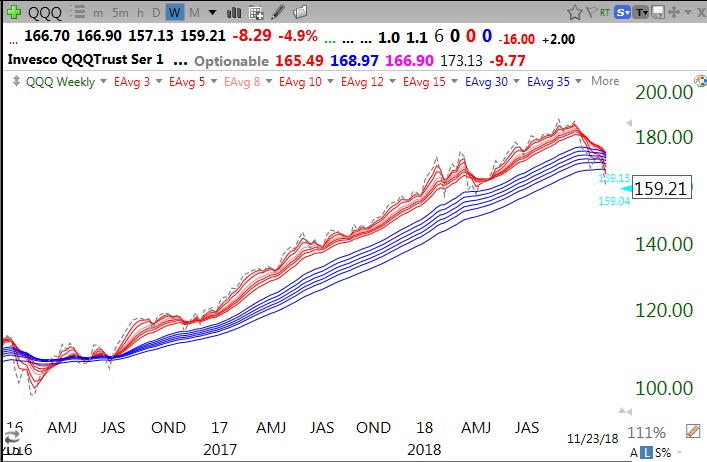

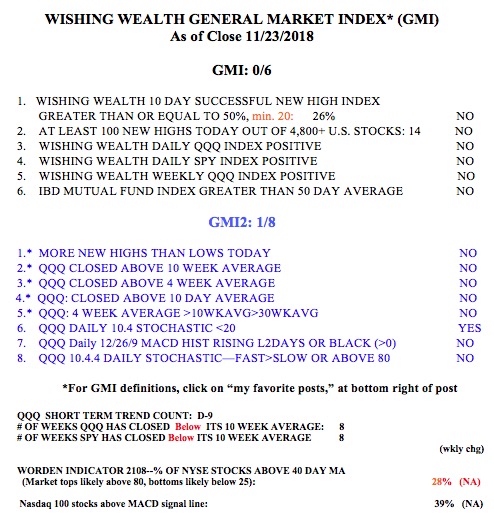

So I am safely in cash, although my new bi-weekly contributions to my university pension continue to go into a growth mutual fund. I don’t mind investing a little new money in mutual funds on the way down–dollar cost averaging. However, I had moved my pension accumulations to a money market fund a long time ago. With the GMI (General Market Index, see table below) at 0, and all major indexes in daily BWR declines, I am content to wait for a bottom and a new up-trend. The GMI often flashes Green well after past markets have bottomed. I don’t mind that. It is the insurance I pay for not being whip-sawed in the failed bear market rallies. I am looking for a return of the GMI, currently 0, to 4 or more for two consecutive days, which will turn it Green. I am also looking for the daily Guppy chart to turn from BWR to RWB. Below is my adapted daily Guppy chart for the QQQ. I am looking for the shorter averages (red lines) to turn up and rise above the longer averages (blue lines), creating an RWB pattern. A constriction in and leveling off of the blue lines, as occurred last April and May, may be the first sign of a developing bottom.

The longer term weekly Guppy chart of the QQQ shows that a strong weekly RWB pattern had existed for two years. That was the time to be invested long in the market! In the longer term context shown by the weekly averages, the current decline appears to be still quite small and not as weak (technically) as the one that occurred in 2016. But the weekly RWB pattern is now gone (white separation between the red and blue lines is gone, see blog glossary) and could signal a much larger decline if it turns into a BWR pattern like the pattern in the daily chart. It is impossible to know in advance if that will occur. A trend follower must follow the likely trend once it has developed. Right now, I remain content on the sidelines.

My blog posts and tweets (@wishingwealth) will announce changes in these patterns and indicators as I see them.

The table below shows that the GMI=0 of 6. The only positive component in the GMI2 is the oversold daily 10.4 stochastic reading for the QQQ, indicating a possible near term bounce. The market writers sentiment poll published at Investors.com, a contrarian indicator, is down to 40% bulls, versus over 60% near the recent market top, a promising sign that the euphoria has vanished among writers of investment letters. In the rare instance when there are more bears than bulls the market is near a major bottom. We are a long way from that, with only 20% bears, and bottoms have occurred without this inversion. Finally, the Worden T2108 indicator available in TC2000 has recovered to 28%, after hitting an intraday low of 7.6% on October 26.

Thank God you’re back!

Do you offer your course on line?

my condolence on your loss

you are very wise, I am not.

Maybe one day.

Danke!

All are wise in their own way.

Hi Dr. Wish. Thanks for your continued blogging. You often use the phrase “in cash”. Can you explain what that means? I assume it does not literally mean you withdraw your funds from the investment company and put them back in your checking account. For example, I have a Roth IRA that uses a Federal Money Market Fund as the settlement fund; all of my Roth IRA money is currently invested a total stock market mutual fund with no money in that settlement fund. In this example, would moving “to cash” mean selling my position in the total stock market mutual fund, thereby moving my Roth IRA money into the money mark settlement fund? And then having it sit there “in cash” (in a more stable money market fund) until I feel the market is back on a reliable upswing and I am ready to buy back into the total stock market mutual fund?

Out of the market and in money market funds.