The GMI has now flashed a Red signal. This is a sign for me to be extra cautious and in cash or short in my trading accounts. The QQQ short term down-trend is now 2 days old. I have a small position in SQQQ, the triple leveraged ETF that is designed to rise three times as much as the QQQ declines. On Wednesday, the QQQ fell -1.3% and SQQQ rose +3.8%. If the short term down-trend persists, I will add to my position in SQQQ. By definition, SQQQ moves quickly up and down.

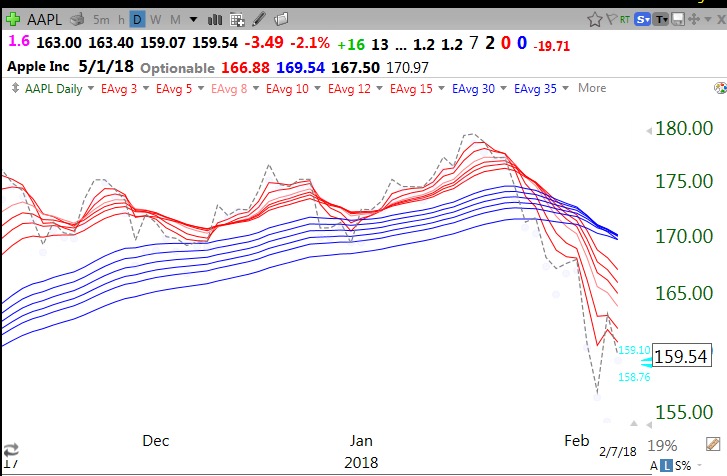

Contributing to the weakness in QQQ, AAPL is now in a daily BWR down-trend with all of its shorter averages (red lines) below declining longer term averages (blue lines).

The debacle in the ETN, XIV, may be behind some of the selling in stocks by hedge funds to raise cash. Check out its weekly chart and learn why ETNs can be much more risky than ETFs–a 95% weekly decline!