While the QQQ remains in short and longer term up-trends, I am dubious very short term because the actions of the daily technical indicators I follow are not consistent with the market’s bounce at the end of last week. During the beginning of the rise in the QQQ that began around April 19 (A) the daily 12.26.9 MACD was rising above its signal line as shown by the histogram’s rising and turning black (B). Similarly, the 10.4 stochastic was rising above its 10.4.4 signal line (C). These 2 short term indicators were strengthening along with the QQQ’s rise. Compare that pattern to last week’s action. While the QQQ started back up (D) the MACD histogram declined and turned red (E) and the stochastic declined (F). This bearish divergence between the action of the QQQ and these 2 indicators suggests to me that Thursday’s and Friday’s rises in the QQQ may have been the proverbial dead cat bounce and should not yet be trusted. (The DIA and SPY exhibit the same divergence.) Of course if these indicators reverse up this week, I might jump back on the train.

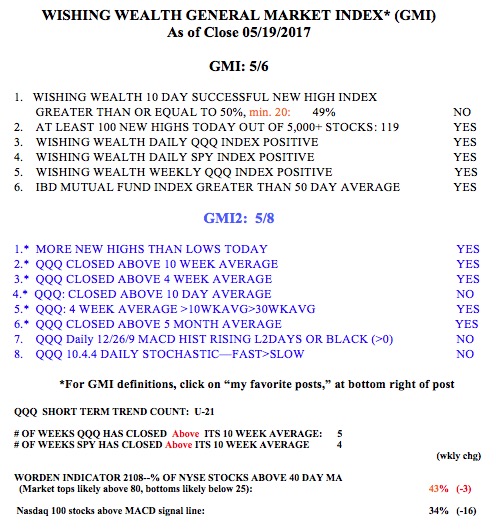

Meanwhile the GMI is at 5 (of 6) and still on a Green signal.