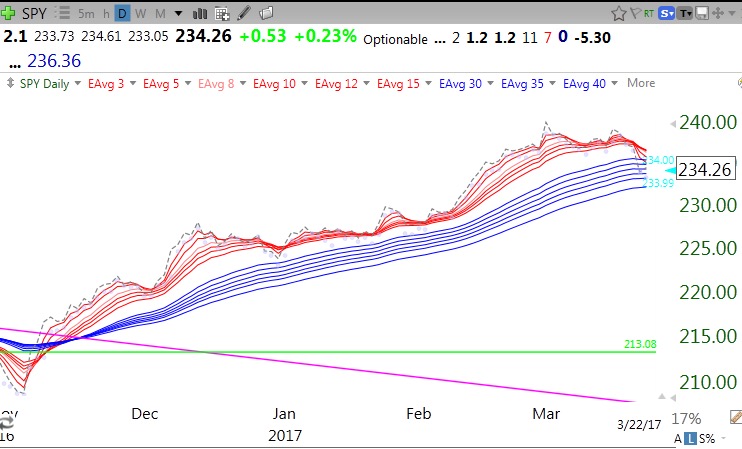

The QQQ short term up-trend has held. But note that the RWB pattern has ended for the SPY on this daily chart.This is the first time since the beginning of this rally in November that the RWB pattern has failed.

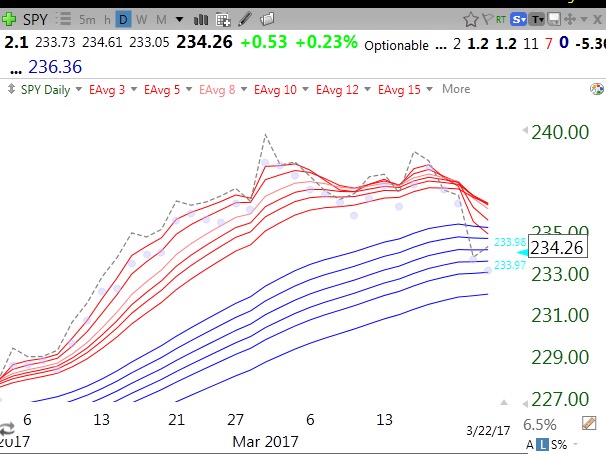

This is a close-up of the daily SPY.

The SPY closed (dotted line) among the longer term averages (blue lines) and is leading the shorter averages (red lines) down to converge with them, making the white space in between them disappear. This is important technical weakness. If the RWB pattern does not reassert itself and a BWR pattern emerges, the decline will be larger and longer. I still suspect a snap back rally this week into the end of the quarter when the mutual funds dress up their quarterly portfolio reports with the strongest stocks. Or you can attribute it to the vote….

Is the Current GMI Signal (upper right corner) correct? Seams to me that it should be at caution. You have taken a cautionary position.

Many thanks for your work on this blog. Been a follower for a long time.