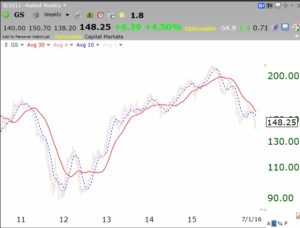

It has been a wild ride with the GMI signals reversing quickly from Sell to Buy. I like to give my signals a few days after a change before I act on them. So I will watch mainly from the sidelines for a while. I am very concerned about the down-trends in many bank stocks. Look at this “naked” chart of the 4,10, and 30 week (red line) averages for GS, a leader in the financial area. The gray solid line is the weekly close, currently leading the other averages lower.

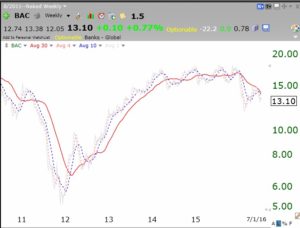

Most of the major banks have emerging down-trends like GS. Here is BAC.

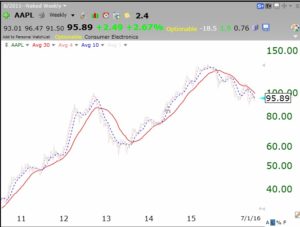

And then there is the ugly AAPL chart.

And then there is the ugly AAPL chart.

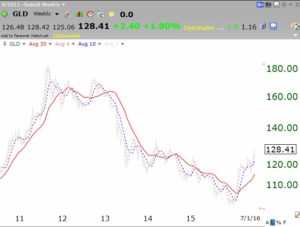

Once charts top out, one never knows where the bottom will be. At least for now, these charts indicate to me stormy weather ahead for this market and maybe the economy. And then there is strengthening gold, GLD, perhaps reflecting fear and a weakening dollar.

Once charts top out, one never knows where the bottom will be. At least for now, these charts indicate to me stormy weather ahead for this market and maybe the economy. And then there is strengthening gold, GLD, perhaps reflecting fear and a weakening dollar.

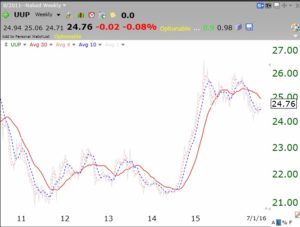

Here is the dollar ETF, UUP. Its 30 week average has topped out.

Here is the dollar ETF, UUP. Its 30 week average has topped out.

And the GMI is now 5 (of 6) and signalling Buy!?

Perhaps the banking type stocks will continue to decline until interest rates start to rise? And that would not take place until after the election?

Perfect timing as usual. You are the best contra indicator I have ever seen. I have gone against you and made a lot of money. Time to go short.

Be careful and watch your ego, over long periods since 2006 the GMI has been on the right side of the market trend.

But you never commit to buy until most of the upside has already happen. Same on the downside. You either need to be more daring and buy a soon as your indicators say(and tell your readers to do the same.) or change your formulas.

Going short between now and the election would not be prudent. The politicians currently in power want to be re-elected and will do everything they can to keep to an easy money policy. If people can borrow money at nearly zero percent and then buy stocks, they will buy stocks.