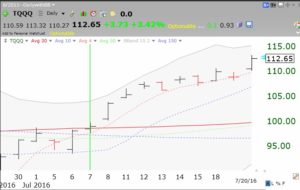

If I had just bought TQQQ on the first day of this new QQQ short term up-trend at the close on 7/11, I would now be sitting on a 13% gain, better than 97% of the NASDAQ 100 stocks! Why do I hunt for the rare super stock when I could just simply ride the up-trend with TQQQ, the 3X bullish QQQ ETF? The first day of the QQQ short term up-trend as I define it is illustrated below by the vertical green line.

The benefits of hindsight 🙂 The leveraged instruments are incredibly volatile though, and as you tweeted recently, “I do not like volatility”. As a 3x leveraged ETF, TQQQ has “strap in because we’re going for a ride” written all over it. For me they are great to watch, but not much else, at least from my perspective. I also do not like the tracking error component, nor do I like the idea of putting a higher percentage of my holdings in one basket. 100% in QQQ or 33% in TQQQ will result in QQQ beating on portfolio performance. I like the GLB methodology, so keep looking for quality stocks that are breaking above the line.

Your post says uptrend started on 7/11 but at the top-right of the web page it says “Current GMI Signal, Buy, since close on July 1, 2016”. Is it 7/11 or 7/1?

Thanks for the question. The GMI measures the short and longer term trend and went to a Buy on 7/1. My QQQ short term trend indicator is separate and focuses only on QQQ and it signaled an up-trend for QQQ on close of 7/7.