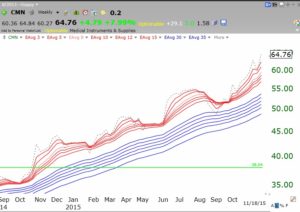

While the indexes are rebounding, it is noteworthy that there were twice as many stocks at new lows than new highs on Wednesday. About 86% of the Nasdaq 100 stocks rose, compared to 67% of all stocks. So the tech stocks are out-performing right now. Only one stock came up in my new high and great fundamentals scan, CMN. It is in a beautiful RWB up-trend.

I am also very wary of this rally because there are still more new lows than new highs – even after the recent 4-day rally. A healthy market would already have more new highs than lows. This evidence indicates that the rallies might be short-covering.

BTW, Marketsmith still assigns UUP an A/D rating of C+, meaning it’s not a good time to bet against the dollar.

From a fundamental standpoint, I don’t understand why the market is behaving this way. I guess we’ll find out in 6 months.