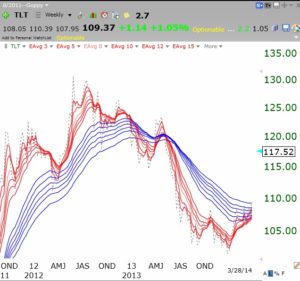

I do not like the weakening in the bonds. TLT is the ETF for the 20 yr Treasury bonds. The RWB up-trend is over and the shorter averages (red) are moving below the longer term averages. As TLT declines, interest rates rise.

The last time we got an interest rate hike scare was 2013.

The last time we got an interest rate hike scare was 2013.

The market did not tank, but it may this time. Since 2nd quarter earnings are now released, I suspect we will get a lull with a weak market until July and earnings come again. I have taken a lot of money off of the table….

The market did not tank, but it may this time. Since 2nd quarter earnings are now released, I suspect we will get a lull with a weak market until July and earnings come again. I have taken a lot of money off of the table….

Eric, thank you for your blog which I follow. I was surprised to hear about your decision to take a lot of money off the table with the indicators (GMI, GMI-2, and T2108) where they are. Does this call for another indicator?