The QQQ failed to break out of its trading channel on Friday.

Interest rates rose on Friday, reflected in falling bond prices. One way to play a future rise in rates and a decline in treasury bonds is through the triple leveled 20 yr U.S. bond bearish ETF, TMV. TMV rose more than 5% on Friday and +16% for the week.

Interest rates rose on Friday, reflected in falling bond prices. One way to play a future rise in rates and a decline in treasury bonds is through the triple leveled 20 yr U.S. bond bearish ETF, TMV. TMV rose more than 5% on Friday and +16% for the week.

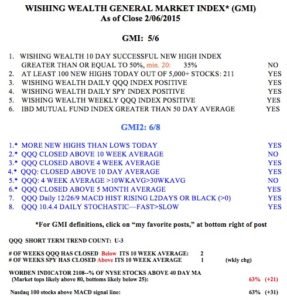

The GMI is at 5 (of 6) and remains on a Buy signal since January 23rd. I remain cautious and ready to act one way or the other. The QQQ closed just below its 10 week average.