The snap-back in my indicators was quick and extraordinary. A new QQQ short term up-trend has begun. However, it has to last 5 days for me to heavily accumulate TQQQ, the 3X leveraged bullish QQQ ETF. I did take a small position in TQQQ at the end of the day on Friday. Buying right after a technical buy signal is actually low risk to me, because if the technical buy signal fails, I can quickly sell out with a relatively small loss. The GMI is above 3, and one more day there and the GMI will flash a Buy signal. Most important, the QQQ is now back above its critical 30 week average (red line), indicating that the Stage 2 advance is still intact. The SPY and DIA also retook their 30 week averages last week.

We are entering what is typically the strongest period for the market, the fourth quarter. (“Buy stocks on Halloween!”) I expect the strong popular stocks to be bought by the mutual funds so their end-of-year reports will include the winners in their portfolios. In this way the fund managers look smart for owning them, even though they may have just purchased them at high prices. It’s all about looking good so potential customers will buy their funds and pay their exorbitant management fees. (Why buy mutual funds when one can buy index ETFs, with their cheaper management fees?)….

Speaking of stocks that institutions will want to own at year’s end, AAPL has regained its critical 10 week average. I have repeatedly found it profitable to own AAPL as long as it stayed above its rising 10 week average. AAPL has again broken above its green line and is well above its 10 week average (blue dotted line). Stocks can sometimes consolidate after a green line break-out (GLB), especially if the market becomes weak. The fact that AAPL came through the recent market turbulence at an all-time high shows impressive relative strength and bodes well for the end of year rally and accompanying mutual fund window dressing.

Another recent GLB that I have written about is BABY. BABY is showing a lot of strength, having plodded higher amidst the recent market turmoil. Notice how it is hugging its rising 10 week average (blue dotted line).

AGIO is another biotech with a recent GLB, that is showing considerable strength.

AGIO is another biotech with a recent GLB, that is showing considerable strength.

A reader wrote to thank me for posting Judy’s first comment to me about RGLS. As my long time readers know, Judy is an incredible stock picker and my stock buddy. Judy reads technical reports voraciously and uncovers gems , often bio-techs, that are working on promising drugs or inventions. She then buys a little and holds them for a long time, if she believes they have a great concept. Unfortunately, I do not have the confidence to hold such stocks for a long time through thick and thin. I have lived through too many bear market declines where everything gets decimated. Anyway, Judy talked to me again and I posted a second time about the prospects for RGLS in Decmber, 2013. At least one reader apparently bought it. Look at what RGLS did last week. Note the GLB last week and its huge volume! Is this the start of something great? (Remember though, clinical trials are risky.)

Another stock that Judy has been urging me to buy is REGN, another recent GLB, which Judy has talked about for a long time. REGN is running clinical trials for several new drugs, including a potential new blockbuster drug for treating high cholesterol. This weekly chart shows a GLB, followed by a multi-week consolidation.

Another stock that Judy has been urging me to buy is REGN, another recent GLB, which Judy has talked about for a long time. REGN is running clinical trials for several new drugs, including a potential new blockbuster drug for treating high cholesterol. This weekly chart shows a GLB, followed by a multi-week consolidation.

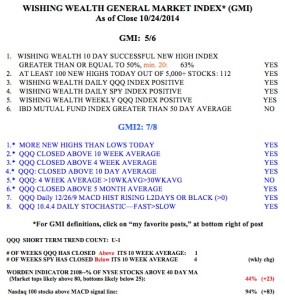

Here is the weekly GMI table. Note that while the QQQ is back above its 10 week average, SPY is not. The large cap industrial stocks are lagging this rebound. This market is not out of the woods yet.

following this site for 4 or so years now, it seems clear to me that the GMI is much too prone to whipsaws like this when the market is in an overall uptrend (not short term swing up and down). Once again, the re-entry is higher than the exit.

Without a better filter to prevent such whipsaw during a short-term pullback, I don’t see that it is a viable strategy — other than perhaps to suggest whether conditions are favorable or not for short term swing trading.

To go from being on the edge of dumping 401k funds to buying leveraged instruments in a week doesn’t seem like a good method. That the seasonally strong period was coming was obviously known a week ago.

I’ve been sitting with 2000s of RGLS underwater since last December. Always had faith that it would breakout. Thanks to Judy and to you for your daily guidance.

Buying a “small position” and just holding long term is not exactly what I do. Position size depends on many factors, including my analysis of the concept, time frame for possible catalysts, optionability, price, my technical analysis etc. If the concept is “proven” by events and stock movement I will then “average up”!! rather than down. Yes I look to TA for when to average up. An example is ISRG, my original entry was $7.00. I quadrupled my position at $71.00 while moaning and complaining. Obviously it was the right move. In IMAX started at .85 added at 1.25 ish 3.50 ish and 10.00 ( I have been totally out for quite a while,since the 30’s) I also use covered calls to let me stay in extended positions.I am often selling, buying back or rolling.

I wanted to add that I often sell covered calls on portions of the position. Also that a one year Linear Regression with 1 and 2 standard deviation indicators is a very useful tool for picking when and what to sell

Thank you for your opinion. I am posting tonight a picture of the QQQ when the GMI was on a buy or sell signal. When a decline begins one never can know in advance how far it will go. To be out of the market during the serious declines means that sometimes the signal will be wrong and one will be whipsawed. I would rather be faked out of the market a few times in order to have the insurance that I will be out during the serious declines. If you have evidence for a better forecasting tool, please share it with us. Remember, my comments are worth every penny that you paid for them.

Dr. Wish, My conclusion is that your GMI is a more accurate timing system than most other systems that I’ve seen (e.g., IBD, VectorVest, and Fibtimer-to name but a few). Additionally, your open trading is as brave as Cramer. And your price cannot, I repeat, cannot be beat. Many, many thanks for all you have shared with us over the years.