The Investor’s Intelligence poll of investment advisers reached a new low (at least, according to IBD, in the past 5 years) last week in the percentage who are bearish–14.4%. Extreme readings like this could imply the market is near a sell-off. When there are few bears and everyone is bullish, they say, there is no one left to buy. The bullish percentage, at 55.7% is still not at a historic peak, however. This means a lot of the polled advisers (about 30%) are neither bullish or bearish. If they convert and the bullish percentage climbs over 60%, I would start to expect a market top….

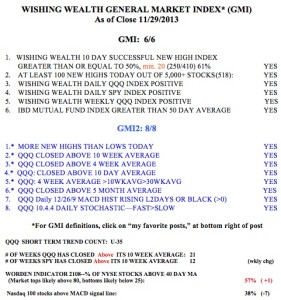

And the T2108, at 57%, is not at an extreme either. When more than 80% of the NYSE stocks close above their 40 day average, the T2108 would be at an extreme overbought reading. With the GMI at 6 (of 6) and the GMI-2 at 8 (of 8) all of my indicators remain positive. Being a trend follower, I just have to wait for these indicators to turn negative before I totally exit this market in my trading accounts.

Does buy and hold work? If one had bought one of these index ETF’s on May 1, 2009 at the beginning of a Stage 2 up-trend, and held through Friday, 11/29/2013, one would have savored the following gains: QQQ +149%, DIA +96%, SPY +107%. And now for the leveraged ETF’s, QLD +449%, TQQQ, +408% because it only started trading on 2/16/10!

All those pundits who say say buying and holding a leveraged ETF does not work should look at these statistics. Yes, I know that in a major bear market these leveraged ETF’s can underperform. But that assumes one has no ability to cut and run when the market turns. And I have the GMI to guide me…….