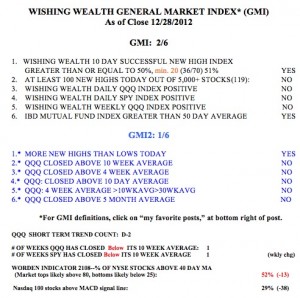

With the GMI having registered less than 3 for two consecutive days, it has now flashed a Sell signal. Friday was also the second day of the new QQQ short term down-trend. I am in cash in my IRA and margin accounts. I want to see what happens with the resolution of the fiscal cliff negotiations before I re-renter the market. Because of the limitations on trading, I am still 100% invested in mutual funds in my university pension–for now. Only two of the four oversold market indicators I watch are oversold, indicating this market could fall further. One of them, the Worden T2108 indicator, is at 52%, in neutral territory.