IBD still says “market in correction.” However, the GMI needs to stay above 3 for one more day for me to have a bullish signal. The market is bouncing from very oversold levels. Last Monday I wrote that the market closed on Friday with 86% of the Nasdaq100 stocks having a daily stochastics below 20. The market closed Wednesday with only 10% of Nasdaq100 stocks having an oversold stochastics below 20. In contrast, only 1% have an overbought stochastics above 80, suggesting to me that this rally has further to go. Last October 14, the percentage of stocks with an overbought stochastics peaked at 81%, nine days before the Nasdaq100 index peaked. The Worden T2108 Indicator doubled on Wednesday, to 65%, back into neutral territory. The market tends to be overbought with readings of 80% or more.

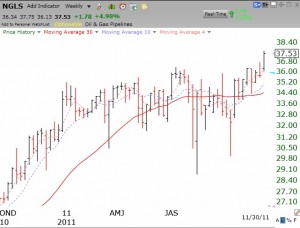

There were 166 new highs on Wednesday out of 5907 stocks. There were only 20 stocks that passed my scan of hitting new highs with great fundamentals. These are (in descending order of EPS gain last quarter): NGLS,QCOR*,ASPS,OKS,SWI*,HITK,HIBB*,FTI,PZZA,MA*,CASY,ATRO,OII,NLC,ARG,FAST,PNRA*,WWD,EPHC,SE. If this rally continues, I would research these stocks for possible leaders. Stocks with an “*” are those that showed up on one or more of my IBD50 watch lists. All of these stocks but 2 are at multi-year highs. Many have broken out from a multi-week base, like NGLS: (Click on weekly chart to enlarge.)

On the five minute chart of the SP-500 on Wednesday there appeared to be high volume and the index moved higher at the end of the day. Would that indicate that institutions are buying?