I never fight the trend of the general market. With the GMI registering 1, and the QQQQ short term down-trend having reached its 5th day, I am confident that the best place to be in my short term trading account is on the sidelines or short. So, I remain in cash and hold a small position in QID. The market peaked on February 16, weeks before the earthquake in Japan. The events in Japan have merely enhanced the speed and the depth of the decline.

I have been writing about a possible change in trend since the up-trend ended on February 22, after its 64th day, and IBD has called this market in a correction for days. The pre-market futures suggest we will get a large decline on Tuesday, at least at the open. It is so much easier to profit from owning stocks during an up-trend, why stay long during a down-trend? It took me many years to learn this valuable lesson. The longer term market trends remain up, for now. But remember, every long term down-trend begins with a short term down-trend.

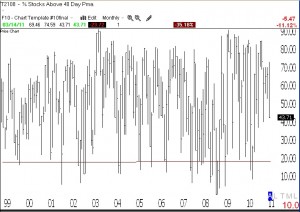

The Worden T2108 Indicator is at 44%, still in neutral territory. A reading below 20% would encourage me to think the market is near a bottom. You can track T2108 yourself by using the Worden program at www.freestockcharts.com and entering T2108 as the stock symbol. Look below at T2108 in a monthly time frame and you will see that many large market declines have ended with the T2108 below 20%. (Click on chart to enlarge.)