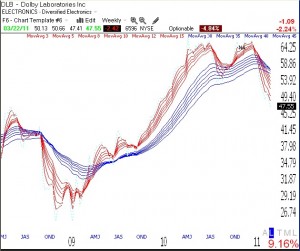

The down-trend continues and the market remains in a correction, according to IBD. I ran my submarine scan to look for possible weak stocks to short. Among the stocks I found are: MICC, AKAM, PVH, SAN, HSP, VCI, CTRP, CREE, DLB. I short stocks in my IRA by buying deep in the money puts. Once the stock falls I often buy shares to lock in the gain and ultimately put them to the option seller at the strike price. Note that DLB now has a BWR pattern, with all of its shorter term averages (red) below its longer term averages (blue). Click on weekly chart to enlarge. BWR is a submarine pattern.

Hi Dr. Wish: Please, what do you mean be “buying deep in the money puts”?

So, who is right….IBD or the market? Stocks like SXCI and LULU are skyrocketting, your BWR is going down…. but the trend is up!!

Further, Why a stock like LULU behaves that way? EPS came out a few days ago with flying colors, much higher than expected, but instead of going up, it went DOWN, and 3 days later it shot UP!! I am staying the course with my stocks and ride the short ups and downs little waves!!!

Did you short Cree By any chance. According to my rules, this would be a short sell signal but I feel that because it gapped down a great deal I am afraid it it may try to retrace itself and I might get wipsawed once again.