My first honors stock market class of the new semester got snowed out today! I will be writing a lot of these posts to familiarize my students with my methods. Click on the highlighted links below to begin to understand the new concepts I use.

All my indicators remain positive, but I am still mainly out of the market now. I am still wary of the municipal bond crisis. I closed out my puts on AGO on Thursday with a nice profit. The market makers would not buy them back at a fair price, so I purchased the shares. I can now put the shares to them at the strike price anytime before option expiration.

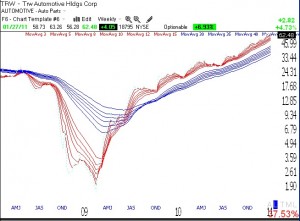

NFLX held its new high nicely on Thursday. There were 413 new highs and only 27 new lows in my universe of 4,000 stocks. TRW hit another all-time high on Thursday and is an RWB rocket stock. Check out the weekly GMMA chart below. TRW reports earnings on February 17.

Below is the monthly chart of TRW. This is the pattern of a rocket climbing to the moon. We buy stocks heading toward the moon, not falling back to the earth. To buy a stock, it must exhibit a confirmed up-trend in the monthly, weekly and daily charts.

Hi,

Can you give more details i.e. the logistics about how you closed or are going to close out your AGO puts please? I didn’t realize that there was another option than taking the market maker’s price for the puts!

You can exercise most options at anytime before expiration. So if I own a put to sell 100 shares of XYZ at $30 (the strike price) and the stock is trading at $25. I can either sell my put in the open market or buy 100 shares of XYZ (currently at $25) and call my broker and tell him to exercise the option to sell the shares at the strike price ($30). Of course I then owe a commission on buying and selling the shares instead of just the one fee for selling the put option. But many times I trade deep in the money options where the bid on the option is so low that I make more money by exercising the option, even after the extra commission. You can obviously do the same with an in the money call. Just ask the broker to exercise the option and buy the shares at the strike price. Most brokers automatically exercise in the money options at expiration. Check with your broker about it and any fees.

Hello,

Thanks to share your experience with us.

You wrote “To buy a stock, it must exhibit a confirmed up-trend in the monthly, weekly and daily charts” Could you explain your criteria with more precision ?

That is what my 14 week course is all about! But you can get an idea by reading my posts about Weinstein stage analysis, my trading strategy, and RWB weekly charts, and by studying the charts I post. Also, check out my 2 free webinars archived (“Professor” in title) at worden.com. Buy William O’Neil’s book and study the patterns of the greatest winners. Hope this helps. The best rules are those you create and test for yourself.

Hi Dr. Wish

I am curious how it occurred to you that the the muni bonds are in trouble. Was it just based on the fact that most of the muni bond indexes had reached new lows and that the majority of the new lows in the market had been within this sector?

The horrible behavior of the municipal bond indexes telegraphed to me the idea that there was something wrong. There was just too much high volume selling. People in the know try to unload their positions before everyone else catches on. Look what happened with Enron!