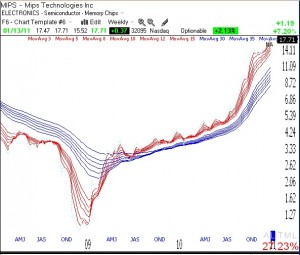

A lot of the stocks I have been interested in really moved up on Thursday. Check out ARMH, PANL, RVBD, ILMN, all of which my stock buddy, Judy, has been interested in for months. MIPS is another stock that Judy likes right now. The weekly GMMA chart shows that MIPS is an RWB rocket stock, with the shorter moving averages (red lines) all above the rising longer term averages (blue lines). The “NA” symbol on the chart indicates that IBD recently wrote about MIPS in its New America column. (Click on chart to enlarge.)

Dr. Wish,

Do you think it is too late to long the market, or do you think there are still some upside potential left?

thanks!

No one knows how long anup-trend will last. One can get in as long as they have good exit rules for getting out.

Dr. Wish – I recently stumbled upon this great website. I have an off-topic question (especially considering the current market strength): does the typical 60-day redemption period for existing and entering mutual funds (in a retirement account) ever interfere with your decision to move to cash once the GMI hits 1, or even 0?

Thanks for your great work!

Thank you for your kind note. My university 403 (B) is in mutual funds that prohibit market timing. In contrast to what I do with my trading IRA, I therefore rarely transfer out of mutual funds in my university account. So I have not been accused of market timing yet. Their rules would prohibit me from going back into a mutual fund that I went in and out of in a short period of time. So, if they did stop me from reentering a fund, I could transfer back into another fund. The short answer to your question is that I transfer out only once a year or less. The GMI would have to go to zero and the indexes I follow would have to show a Weinstein Stage 4 decline pattern. Furthermore, in the worst case scenario I might have to sit in cash in a money market fund for a few months. I refuse to stay invested in equity funds when I think we have begun a major decline.