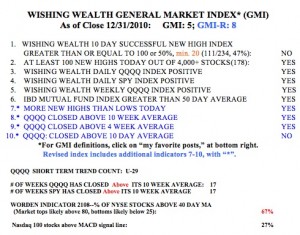

There was weakness in the leaders on Friday with all nine stocks declining, and five of them have closed below their 30 day averages. Only 28 of the Nasdaq 100 stocks rose.  Furthermore, only 27 of the Nasdaq 100 stocks closed with their MACD above its signal line, reflecting short term weakness. Nevertheless, the short and long term trends of the major indexes (SPY, DIA, QQQQ) remain up. I am invested 100% in mutual funds in my university pension, but in my IRA trading account I am holding long positions that are largely protected by put options. As I explained in a post in 2009, buying puts for insurance is an effective strategy for controlling risk, especially for large long positions. I am uncomfortable when market leaders like NFLX, CMG and BIDU weaken.

Furthermore, only 27 of the Nasdaq 100 stocks closed with their MACD above its signal line, reflecting short term weakness. Nevertheless, the short and long term trends of the major indexes (SPY, DIA, QQQQ) remain up. I am invested 100% in mutual funds in my university pension, but in my IRA trading account I am holding long positions that are largely protected by put options. As I explained in a post in 2009, buying puts for insurance is an effective strategy for controlling risk, especially for large long positions. I am uncomfortable when market leaders like NFLX, CMG and BIDU weaken.

Only a fool would follow a bear in such bullish times

Love your posts! Keep up the good work.