Monday was the 30th day of the current QQQQ (Nasdaq 100 ETF) short term up-trend. The prior short term up-trend lasted 51 days and was followed by a brief two day down-trend. Thus, we have been in a short term up-trend for 81 of the past 83 days. The GMI nd GMI-R are at their maximum levels. It rarely gets much better then this…….

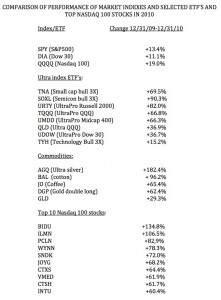

I did an analysis of how the major Indexes performed in 2010, compared with exchange traded funds (ETF’s) and the top performing Nasdaq 100 stocks. (Click on table to enlarge.) I again came to the same conclusion I have posted about before. If one is confident of the trend of the major indexes, it is far easier to just ride the appropriate leveraged index ETF than to attempt to find the few individual stocks that will outperform them.

The SPY increased +13.4% last year, the DIA, +11.1%, and the QQQQ, +19.0. As we all know, most mutual funds compare their performance with that of the S&P500 Index, reflected in its ETF, SPY. But remember, mutual funds cost more than ETF’s because of larger sales and management fees. So over time, most mutual funds fail to consistently beat the S&P 500 Index. But look how well the leveraged Index ETF’s did last year. If one thought that the tech stocks were in an up-trend and one bought the TQQQ (UltraPro QQQ ETF) one’s account would have grown +66.8%, more than three times the QQQQ and five times the SPY! Even the double QQQQ ETF, QLD, advanced +36.9%. In the past, I traded TYH (+15.2%), as a leveraged ETF proxy for tech stocks, but now I have discovered that the TQQQ performs much better. Some commodities did quite well last year, especially gold and silver. If one bought the popular gold ETF, GLD, it went up +29.3%, but the double long gold ETF, DGP, went up +62.4%. The Ultra silver ETF, AGQ, increased +182.4%! Finally, note that only the top performing 10% of the Nasdaq 100 stocks went up 60.4% or more.

Now, how likely is it that we are going to do trying to identify the minority of individual stocks that outperform the leveraged ETF’s and investing heavily in them? I suggest that if one is going to go long, one can do much better by just buying some of these leveraged index ETF’s. How much easier this is than looking for the proverbial needle in the haystack. In addition, one does not have to worry about adverse news or earnings from a single stock decimating one’s portfolio. The Index, by definition, reflects the performance of a number of stocks.

As I have written before leveraged ETF’s go up and down faster than their underlying index. So, if the GMI indicates we are in an up-trend, I wade in slowly and only buy more as the index climbs and confirms the trend. My guess is that the financial establishment, brokers and mutual fund managers, do not want us to discover the value of riding these index ETF’s. It means less money under management and less trading, resulting in fewer transaction fees and less income for them. They typically try to scare us away from them by saying that they go down faster than they go up. But remember, unlike mutual funds, you can exit ETF’s during the day and use stop losses. You can also buy back in at will, if you decide you were wrong. So you can manage risk a lot more effectively than with most mutual funds which tend to prohibit market timing and which only let you exit at end-of-day prices. Just remember, the data in the table provide the evidence of performance for the entire past year. (I have not even touched upon the additional use of the inverse leveraged ETF’s to protect oneself during a sustained market down-trend.) The GMI keeps me on the side of the market’s trend and guides my selection of ETF’s. I especially like to buy the bullish leveraged ETF on the first day of a new QQQQ short term up-trend. What do you think?

I don’t know which broker you use but I use Interactive Brokers and their overnight margin requirement for leveraged ETFs is 100% whereas it’s 50% for stocks. So if I buy a triple leveraged ETF for $10,000, I need $10,000 margin. Alternatively I could buy a stock for $10,000 with $5,000 margin which gives me double leverage. So if TQQQ returned 66.8%, any stock above 33.4% return with double leverage would have been been better for me.

IB margin requirements are explained here: http://www.interactivebrokers.com/en/p.php?f=margin

Thank you for your very insightful comment. For those of us trading in IRA’s or other nonmargin accounts, the leveraged ETF’s would excel. Agree?

Yes, fully agreed!

Your comment of easing in to the leveraged position, can you be more specific, what percent of your portfolio is your initial position and how much do you increase it by? What does the index have to do to increase your position? At what level of GMI would you exit the long ETF and go with the short ETF? Do you use stage analysis on these ETFs? Thanks for all your great work!

There is no reason I can see to trade GLD or SLV. You can invest half the amount for equal risk in DGP and AGQ. Why tie up more money in GLD or SLV?

For taxable accounts, I no longer trade GLD, SLV, DGP or AGQ, UCO, UNG, DBO, or any other commodity-based ETF, even though I traded them all successfully in 2009. The reason is that they generate incomprehensible and annoying K-1 forms, and I don’t need more tax hassles. Also, it is possible to lose money in GLD, yet receive K-1 forms that show you had a gain, similar to mutual funds. To profit from gold, since Jan. 2009 I have been very successful riding GDX (gold miners stock index), which does not generate a K-1 form. I trade Fidelity Gold FSAGX in my 403b exactly as GDX, because FSAGX and GDX are correlated 0.99 (see http://www.assetcorrelation.com).

Overall, I agree that riding TQQQ is best, and UPRO second-best, as UPRO gives more entry opportunities during uptrends. However, because during a big uptrend there may be few opportunities to add to TQQQ, therefore, it is still useful to take small profits on stocks in uptrends by buying on pullbacks and selling on rises. Rarely are there two days straight without an opportunity to enter some stock, because there are so many stocks. The same cannot be said about the indexes, because there are few of them.

You would have to take my 14 week university course to fully understand these issues. Stage analysis is critical to understanding the trend of stocks, ETF’s and the general market. You need to study these issues and determine your own rules for averaging up and managing risk. Start by reading Stan Weinstein’s chapter (in his book, Secrets of….) on stage analysis and Wiliam O’Neil’s book, How to Make Money in Stocks. Perhaps the best example I have found of a specific system for increasing one’s position and managing risk is in Michael Covel’s, The Complete Turtle Trader. Also read LeFerve’s book (Reminiscences of a …) on Jesse Livermore for an understanding of these issues and the psychology of trading. These books should give you the basics for designing a set of rules that you will have confidence in and fit your personal style. The books are all listed to the lower right of my blog post page. Good luck!

Thank you for the very valuable information. I trade largely in an IRA and do not have to worry about the tax consequences you mention.

I have a web site where I research stocks under five dollars. I have many years of experience with these type of stocks. I would like to comment about leveraged exchange traded funds. I think exchange traded funds are great I do not feel the same way about leveraged exchange traded funds these things are way to risky especially the three or four to one leveraged exchange traded funds. I would recommend investors avoid these risky investments.