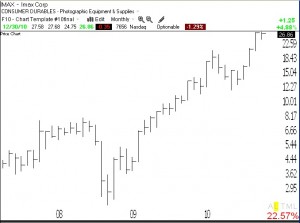

Yesterday, I bought some call options (actually a bull vertical spread) on IMAX because it bounced from support. I have been following IMAX for years because my stock buddy, Judy, had alerted me to it, in April 2008! Judy liked the 3D theater concept. Check out my first post on IMAX. Judy tells me she first bought IMAX at about$1.25 per share. It is trading premarket today at $30 based on buy out rumors. Over the years a lot of Judy’s “concept” stocks have been bought out by other companies. From time-to-time I post Judy’s picks. Here is a monthly chart of IMAX. (She obviously bought IMAX cheaper before 2008.)

Way to go Judy and Dr Wish. I have been following you both for several years and learned a lot. Always great insight and useful info. I am so glad I found your sight when I did. Happy New Year and Happy Trading in 2011.

imax Is a pefect example of an over valued stock. I have be following stocks for many years. let me give you an example of a really under valued stock sanmina-sci corp.symbol ‘sanm’ the company is in the integrated electronics manufacturing services business the shares trade around 11 to 12 dollars. I think the stock could easily reach 100 hundred dollars a share over the next five years. the company is doing over 7 billion in worldwide sales the company has 600 hundred million in cash on its balance sheet yet trades at a very low price.

“Overvalued” stocks tend to become more overvalued. SANM was at $223 in 2000 and is currently in a Stage 4 down-trend. It does not meet the technical criteria I use for a buy. I do not bottom fish. However, I might become interested if it ever breaks above $223. I only buy stocks at or near all-time highs.

Good call again Judy! Dr. Wish, did Judy use any materials during her presentation at UMD with your Honors class. If she did, would it be possible to share those documents. I wanted to learn more about how she researches/finds these amazing stocks. Happy New Year!