I am amazed at how effective the GMI and GMI-R have been for keeping me on the right side of the market. While the media pundits were talking about a possible double dip recession and a head and shoulder’s top on the indexes, the GMI went positive with a reading of 4 on September 3rd and has registered 5 or 6 since then. This time when the buy signal occurred I bought QLD (the 2X ultra long QQQQ index) and have seen it rise nicely, capturing the strength in the technology stocks. I also bought options on AAPL and more recently on GOOG and have seen one of my accounts increase more than 100%. In a prior post I showed you how to buy expensive stocks like AAPL with only 10% down using deep in the money call options. I bought deep in the money calls on AAPL recently and the trade worked out well. Check out my earlier post………

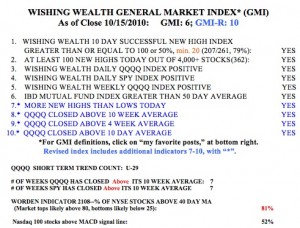

So the GMI remains at 6 (of 6) and the more sensitive GMI-R at 10 (of 10).  The QQQQ short term up-trend completed its 29th day on Friday and the QQQQ and SPY have closed above their critical 10 week averages for 7 straight weeks. The T2108 has weakened a little to 81%, still near overbought territory. More than one half (52%) of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. So, I remain 100% long in my university pension and my margin account. My IRA is substantially invested in long positions in stocks or options…

The QQQQ short term up-trend completed its 29th day on Friday and the QQQQ and SPY have closed above their critical 10 week averages for 7 straight weeks. The T2108 has weakened a little to 81%, still near overbought territory. More than one half (52%) of the Nasdaq 100 stocks closed with their MACD above its signal line, a sign of short term strength. So, I remain 100% long in my university pension and my margin account. My IRA is substantially invested in long positions in stocks or options…

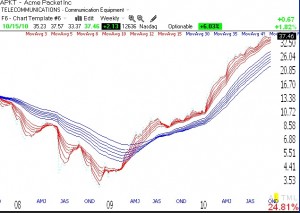

I ran my favorite scan of stocks in my IBD100/NEW America watch list, looking for stocks that were in up-trends and bouncing up off of support. One of the stocks that came up was APKT. The weekly chart below (click on to enlarge) shows that APKT is a RWB stock. I like it as long as it remains above $36.