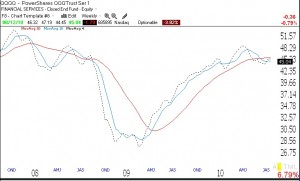

The GMI and GMI-R are each registering 2. Don Worden wrote Thursday night about a possible head and shoulders top, as I did 2 days ago. I am not yet ready to call a top. It will take a few more declines to convince me. But with a GMI of 2, it is prudent to be defensive and to raise stops and cash. With two of the bull market leaders, NFLX and PCLN, hitting new all-highs on Thursday, it is hard to say that the bull is dead. We could just as easily be setting up a head and shoulder’s top as a bottom! The market has bounced around in a range for quite a while. The chart below (click on to enlarge) shows the weekly plot of the QQQQ and its 4,10 and 30 week averages. If we look at the prior recent tops, one can see that the 4 week average typically falls below the 10 and the 30 week averages and leads the decline. At the present time, the 4 week average (black dotted line) is above the 10 week average (blue) and below the 30 week average (red). As long as the 4 week average remains above the 10, I am not ready to call it a major down-trend. Still, there is no reason to be brave when the market averages look like this. Better to conserve my capital until things look better.

Check the Hindenburg signal.

Eric- On Wednesday, you warned that the market might falter–it did.

Although reading your indicators and commentary up until that post, most would conclude that it was safe to re-enter the water, albeit cautiously. What tipped you off? Was it a Worden scan? Futures that morning?

Hi Vince,

I think I can answer that question for you. Dr. Wish made reference to how the futures had a very weak fair value. With that happening, the market opened below the 10 day moving average support. Moreover, the T2108 indicator seemed to drop as well. In addition, you can look at the daily chart of the qqqq and the Dj-30, and you can see that bid drop we had on Tuesday meant that the price action was below the 10 day MA for both DJ-30 and the QQQQ. In addition, the price action on QQQQ also broke 30 day MA support. However, it remains to be seen if the DJ-30 price action will bounce off its 30 day MA or break support as well, in which case it is prudent to wait and see what the market will do.

Nice response, Chris. My reason for additional caution was the declining futures that morning.