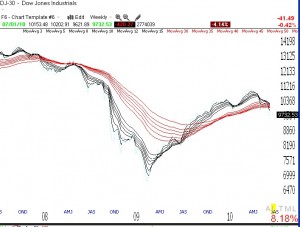

With my indicators at zero, I remain in cash and short in my trading IRA. The Worden T2108 Indicator is at 25%, still above oversold territory. The GMMA weekly chart of the Dow 30 Index (click on chart below to enlarge) shows that the short term weekly averages (black) are beginning to fall through the longer term weekly averages (red). Take a look at what happened in 2007-08 for a hint of what may come.

An interesting new op-ed on the bond vigilantes.

I have been reading your blog and market commentary daily and appreciate your sharing of knowledge with us.

I have a question regarding market timing. Did you buy TYP and put options on 6/29 on the day of big gap down or earlier? The reason I am asking is that it appeared on 6/29 that market is oversold with already down 5 days in a row and it would be risky to short the market as it could bounce. I am trying to learn your methods as they suit me in terms of timeframe and day job I have to maintain. Thanks and appreciate your feedback

I tend to short the market a little on the first day that the new QQQQ short term down-trend is identified, here on 6/25. The safest time to short is when I first get the sell signal because I can then cover with minimal losses if the index reverses and signals an up-trend.I prefer to trade around 3:45 PM because I then have an idea of the closing level for the day. Hope this helps.

Spent too many years trying to fight the market, even while aware of your blog and trading methods. Well, you’ve finally convinced me. I’m now using the GMI/GMI-R to determine when I should be in or out (or short) of the market. And using a chart of multiple short and long EMAs has allowed me to pick better entry and exit points. I bought SH (shorting SPY) on Monday, and have already been rewarded. Thanks for publishing, and keep up the good work.

Thanks for the response. One other question; what is your exit strategy on trades in your trading IRA account. Do you have targets where you exit, or do you trail stops. Also, what is the stop loss on such trades, would it be same for all; i.e, GMI turning green or you manage the stops of individual positions by certain stop loss strategy. I am asking because it seems like you like to ride the trend, which could mean wider stop loss or no stop loss at all.

Appreciate your feedback.

Dr. Wish:

When do you go to cash in the IRA?

Hi again,

Also on a related note regarding market timing and start of trend. I am wondering if you went long on the start of uptrend back on June 17 or June 18. Did you take losses on those positions, when trend reversed. Thanks in advance.